by Martin Jürgens, Dr. Götz-Andreas Kemmner, Alois Fuchs1

Bankruptcies are the entrepreneurial worst-case scenario. However, the factors that lead to insolvencies can also be found in many other companies. It therefore makes sense to know the sources of errors in insolvent companies and to check whether similar errors have crept into your own business, as they can cost even apparently healthy companies a lot of money. The circuit board assembler Semecs, Neunkirchen, which went bankrupt last year along with the entire Semecs Group and is now operating successfully on the market under the name Neways-Neunkirchen as part of the Neways Group, also based in the Netherlands, illustrates some of the common growth mistakes in day-to-day business.

One of the main reasons for the insolvency of the Dutch Semecs Group was its planning, which was primarily geared towards expansion and resulted in unreasonably high fixed costs that were difficult to reduce. Semecs Neunkirchen, which had already expanded its production capacities, was also affected when sales did not continue to rise as expected due to the weak telecommunications market, but instead collapsed. The attempt to close a German plant and distribute its production to the other plants also failed. It was realized far too late that the closure costs could not be financed. Cost adjustments could no longer be made in time or were too expensive. This was followed by an unstoppable chain reaction via the Group allocations.

This mistake is made in planning by anyone who plans their figures based on gut instinct, extrapolates past developments into the future without paying attention to the life cycles of products and markets or forgets that reducing fixed costs first causes additional costs. But even if you take these factors into account, you should pay attention to your own flexibility during growth phases, keep the marginal employment rate as low as possible and plan growth carefully and with reliable figures.

Careful and resilient planning

therefore applies not only to restructuring cases, which are scrutinized particularly closely by potential investors, but also to discussions with investors during normal business operations and talks with banks. From this perspective, the disquiet of some entrepreneurs about the behavior of their commercial banks is also put into perspective. Anyone who presents a plausible business plan backed up with reliable figures will still receive funding today.

Understandably, in such cases, income statements that lead to short-term earnings are more acceptable than planning scenarios that only promise profits years down the line. Our practice has shown that in restructuring cases, discussions with new investors and banks only make sense if a “black zero” in the first financial year is the result of conservative planning.

The sales planning of the business plan, which Abels & Kemmner prepared on behalf of the insolvency administrator, lawyer Udo Gröner, for a Semecs continuation company in Neunkirchen, was based on the existing business relationships and sales planning. The figures were evaluated and weighted according to the probability of occurrence. The sales plan, like the entire business plan, was created in an investor-neutral manner and served as a planning basis for potential investors, who adapted it to their needs either independently or with our support. As in almost every restructuring case, we planned the budgeted sales extremely conservatively and with verifiable facts, and applied a safety margin of around 10% to make the figures as reliable as possible. This conservative planning approach has proven itself in the past and we can only recommend it to every medium-sized company. Even if the sales trend is likely to be more positive, it is rarely a problem to realize this sales potential. This approach helps to keep the marginal level of employment low; the hopefully existing sales growth compared to planning must then first of all be managed through productivity increase measures.

Work out core competence

At Semecs Neunkirchen, operational planning was based on existing relationships with well-known customers from the automotive, industrial and telecommunications sectors. This has resulted in a customer portfolio with a sufficient mix of sectors, meaning that there is no longer any reason to fear any serious sector bias in the future. The surplus of Telekom customers should not break the company’s neck again. In addition, Semecs Neunkirchen had a certain technological leadership in the assembly of flexible printed circuit boards, a market segment that is growing and is not dominated by every PCB assembler. In the new Neways Group, to which the company now belongs under the name Neways Neunkirchen, this area is to be further expanded in future using conservative planning approaches. The less lucrative, because labor-intensive, purely manual assembly component (THT) in the series business is to be further reduced or outsourced through cooperation with less technologically oriented contract assemblers.

Observe added value per employee

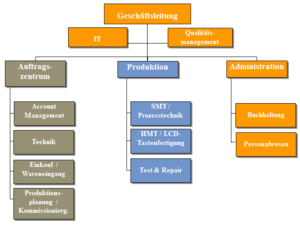

The resources required to fulfill the sales plan data could be determined relatively quickly using the key figure “value added per capita” and used as a benchmark for comparison with competitors. We determine the added value pragmatically from turnover minus material costs. The sales plan figures, which were determined on the basis of the orders that could realistically be achieved, resulted in the tough but justified requirement to reduce the number of employees. The decision criteria developed for this drastic cut, as well as the decision itself, were supported by the works council, as the workforce also recognized that the continued existence of the site was not possible otherwise. In total, personnel costs had to be reduced by 56%. Management positions also had to be cut in the process. Sales, technology and logistics were combined in a process-oriented order center and placed under central management. This gave the originally function-oriented organizational structure a cross-functional, customer- and process-oriented structure for the first time, with positive effects on the cost structure. In addition, the independent maintenance and process technology departments were integrated into production, allowing the highly qualified staff to contribute to ongoing production and thus add value. By setting up an employment company, insolvency administrator Udo Gröner was able to cushion the impact of the job cuts on those affected. Material costs (energy, maintenance, leasing, etc.) were reduced by a further 17% compared to the existing plan.

All these measures led to a significant reduction in the marginal employment rate. Benchmarking with an electronic component manufacturer and assembler interested in purchasing the company confirmed that the restructuring measures introduced had brought the cost ratios back to the right level. Semecs was only 1 to 2% higher than the potential buyer with its budgeted figures for the first year in terms of personnel costs. In the second year, the cost planning was in line. The small backlog resulted from the costs still required as part of the redesign of the organizational structure, which should be completed by the end of the first year.

Time is money

In the case of Semecs, a complete restructuring of the organizational structure, which was too large for the current planning data, was carried out in cooperation with the management within just two months in order to significantly streamline the value chain. The speed of restructuring in reorganization cases is required by the insolvency administrator for creditor protection alone. But even companies that are still healthy should act consistently and quickly. Any unrest in a company that lasts longer than necessary jeopardizes the motivation of management and employees in the long term, as restructuring measures entail a high degree of uncertainty for everyone involved. You often run the risk of losing your most important employees. In the case of Semecs, all employees who were important for the continuation of the business were retained, which was ensured not least by the clear and reflective communication strategy and the pragmatic approach.

Clearly defined business transactions and secure scheduling

When determining the planning data, it became apparent that the business processes and workflows were not organized stably enough and that the necessary transparency was lacking in materials management due to poor data quality. The figures for materials management, which represents the largest cost block of a PCB assembler with a material share of the end product of >60%, were maintained in heterogeneous IT systems, which is quite untypical for the otherwise highly automated assembler. Data had to be exported from the ERP system and then processed remotely in complex procedures with database and spreadsheet programs. This effort has so far made it necessary to extend the cycles between the material requirements determination runs. With annual material costs of around €7.6 million, inventory values of more than €1.5 million were being pushed forward, which was considerable in relation to throughput times. However, Semecs needs more or less up-to-date stock requirements in order to make optimum purchases on the component market, where prices are sometimes daily prices and products are subject to a rapid ageing process. To make this possible, immediate action was taken at the system interfaces, which significantly shortened the cycle and the effort required for the material requirements determination runs.

In addition to optimizing inventory management, further measures were required to increase productivity. Our analysis showed that too many business transactions were handled variably. The company, coached by Abels & Kemmner, is currently working hard to optimize its business processes. As a result, the efficiency of order processing can be significantly increased and the functions of the existing ERP system BAAN can now be better utilized.

Within 2.5 months, stocks of raw materials were reduced by approx. 13%, stocks of finished products by approx. 20% and stocks of semi-finished products by as much as 48%.

Successful new start

The most important adjustments were made within two months and the course was set for the future. In discussions with potential institutional and industrial investors, it quickly became clear that the business plan was viable and that the prospects for success of the restructured company, which had focused on its core competencies and been relieved of unnecessary resources, were positive. With Neways Electronics International N.V., a strong buyer was found that represented the most sustainable solution for the company and its employees, as Neways has an excellent market position and brings additional orders to the company. Neways’ goal of improving its access to the German electronics market, which is the most important in Europe, with the acquisition of Semecs Neunkirchen also promised a prominent position for the company within the Neways Group. The company made a promising new start with 49 employees, less than half of its previous workforce. On the basis of conservative, investor-neutral planning with a “black zero”, a clearly positive result can now develop. This has led to extremely agile business operations and highly motivated employees.

Supported by Abels & Kemmner, the old management is successfully and rapidly driving forward the restructuring and optimization of business processes initiated during the insolvency phase in the new Neways Neunkirchen GmbH.

Solid planning always finds investors

The result of the reorganization has shown that companies in crisis situations and even insolvent companies have a chance of survival and can find new investors. Provided that the company’s framework conditions (market, suppliers, customers, value chain, management system) are in place and that it acts consistently and plans seriously. Determining the real situation of a company and its actual future viability involves more than just analyzing past figures through the eyes of an auditor. In addition to financial and accounting restrictions, a company’s future prospects also depend on its market potential and its technical and organizational potential. A business plan must therefore be drawn up “bottom up” from the market based on the resources and infrastructure required to provide the service and must not just be examined “top down”. It is not sufficient to check inaccuracies and errors only on the basis of random samples or plausibility analyses. On the basis of solid bottom-up planning, banks also find it less difficult to provide SMEs with the necessary funding. Our task in restructuring projects is often to support companies in designing such corporate plans. Abels & Kemmner acts as an objective and neutral mediator for the respective negotiating partners, be they insolvency administrators or companies seeking liquidity. This is the only way to gain the trust of all parties involved, which is needed to develop successful solutions and the only way to benefit the parties, as only a resilient business plan will be successful in the long term anyway. So protect yourself from overly euphoric or unreliable planning.

1Mr.Alois Fuchs is Managing Director of Neways Neunkirchen GmbH