by Dr. Götz-Andreas Kemmner and Alois Fuchs

Bankruptcies are the entrepreneurial worst-case scenario. The factors that lead to insolvencies can be found in many companies. For this reason, it is helpful to know the sources of errors in insolvent companies and to check whether similar errors have crept into your own company. Semecs, Neunkirchen, a PCB assembly company that went bankrupt last year with the Semecs Group and is now operating successfully on the market under the name Neways-Neunkirchen as part of the Dutch Neways Group, highlights some of the common growth mistakes in day-to-day business.

One of the main reasons for the insolvency of the Dutch Semecs Group was its planning, which was primarily geared towards expansion and resulted in unreasonably high fixed costs that were difficult to reduce. Semecs Neunkirchen, which had already expanded its production capacities, was also affected when sales did not continue to rise as expected due to the weak telecommunications market, but instead collapsed. The attempt to close a German plant and distribute its production to the other plants could not be implemented. The company management realized far too late that the closure costs could not be financed. Cost adjustments could no longer be made in time or were too expensive. This was followed by an unstoppable chain reaction via the Group allocations.

This mistake can be made by anyone who plans their figures based on gut instinct, extrapolating past developments into the future without considering the life cycles of products and services.  markets or forgets that the reduction of fixed costs first of all causes additional costs. But even when these factors are taken into account, you should pay attention to your own flexibility during growth phases, keep the marginal employment rate as low as possible and plan growth carefully and with reliable figures.

markets or forgets that the reduction of fixed costs first of all causes additional costs. But even when these factors are taken into account, you should pay attention to your own flexibility during growth phases, keep the marginal employment rate as low as possible and plan growth carefully and with reliable figures.

Careful and resilient planning

therefore applies not only to restructuring cases, which are scrutinized particularly closely by potential investors, but also to discussions with investors in normal day-to-day business and negotiations with banks. From this point of view, the disquiet of some entrepreneurs about the behavior of their banks is also put into perspective. Anyone who presents a plausible business plan backed up with reliable figures will still receive funding today.

Understandably, in such cases, income statements that lead to short-term earnings are more acceptable than planning scenarios that only promise profits years down the line. In practice, it has been shown that in restructuring cases, discussions with new investors and banks only make sense if a “black zero” in the first financial year is the result of conservative planning.

On behalf of the insolvency administrator, the consulting firm Abels & Kemmner drew up a business plan for a Semecs continuation company in NEUNKIRCHEN, which was based on the existing business relationships and sales planning. The figures were evaluated and weighted according to the probability of occurrence. The sales plan, like the entire business plan, was prepared in an investor-neutral manner and served as a planning basis for potential investors, who adapted it to their needs either independently or with our support. As in almost every restructuring case, we have applied a conservative approach to the budgeted sales, based on verifiable facts and with a safety margin of around 10% to make the figures as reliable as possible. This conservative planning approach has proven its worth in the past and even if the sales trend is more positive, it is rarely a problem to realize this potential. In addition, this approach helps to keep the marginal employment level low; the hopefully existing sales growth compared to the plan must then first be managed with the help of measures to increase productivity.

Work out core competence

At Semecs Neunkirchen, operational planning was based on existing customer relationships. This has resulted in a customer portfolio with a sufficient mix of sectors (automotive, industry and telecommunications), meaning that there is no longer any reason to fear any serious dependencies on individual sectors in the future. The surplus of customers from the telecommunications sector should not break the company’s neck again. In addition, Semecs Neunkirchen had a certain technological leadership in the assembly of flexible printed circuit boards, a market segment that is growing and is not dominated by every PCB assembler. In the new Neways Group, to which the company now belongs under the name Neways Neunkirchen, this area is to be further expanded in future using conservative planning approaches. Further planning envisages further reducing the less lucrative, because labor-intensive, purely manual assembly part of the series business or outsourcing it by cooperating with less technologically oriented contract assemblers.

Observe added value per employee

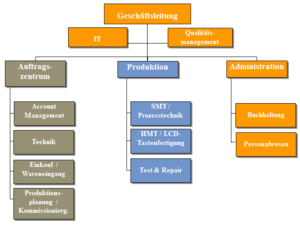

The resources required to fulfill the sales plan data could be determined relatively quickly using the key figure “value added per capita” and used as a benchmark. The value added was calculated from sales less the cost of materials. The restructuring team used the orders that could realistically be achieved as the basis for calculating the sales plan figures. This resulted in the requirement to reduce the number of employees. The decision criteria for this drastic cut, as well as the decision itself, were supported by the works council, as the workforce also recognized that this was the only way to ensure the continued existence of the site. In order to achieve the target of 56% reduction in personnel costs. management positions also had to be reduced. Sales, technology and logistics were combined in a process-oriented order center and placed under central management. This gave the originally function-oriented organizational structure a cross-functional, customer- and process-oriented structure for the first time, with positive effects on the cost structure. In addition, the independent maintenance and process technology departments were integrated into production, allowing staff to contribute to ongoing production and thus add value. By setting up an employment company, the insolvency administrator was able to cushion the impact of the job cuts on those affected. The material costs (energy, maintenance, leasing, etc.) could be reduced by a further 17% compared to the existing planning.

All these measures led to a reduction in the marginal employment rate. Benchmarking with an electronics manufacturer and assembler interested in the takeover confirmed that the restructuring measures introduced had brought the cost ratios back to the right level. Semecs’ budgeted figures for personnel expenses for the first year were only approx. 2% higher than the potential buyer. In the second year, cost planning was at the same level. The small backlog resulted from the costs still required as part of the redesign of the organizational structure, which should be completed by the end of the first year.

Time is money

In the case of the PCB assembler, a complete restructuring of the organizational structure, which was too large for the current planning data, was carried out in cooperation with the management within just two months in order to significantly streamline the value chain. The speed of restructuring in reorganization cases is required by the insolvency administrator for creditor protection alone. But even companies that are still healthy need to act consistently and quickly. Any unrest in a company jeopardizes the motivation of management and employees in the long term, as restructuring measures involve a high degree of uncertainty for everyone involved. In many cases, there is then a risk that the most important employees will leave the company. In the case of Semecs, it was possible to retain all employees for the continuation of the business, which was ensured not least by the clear and reflective communication strategy and the pragmatic approach.

Clearly defined business transactions and secure scheduling

When determining the planning data, it became apparent that the business processes and workflows were not organized stably enough and that the necessary transparency was lacking in materials management due to poor data quality. The data for materials management, which is required for a material share of the end product of >60% of a PCB assembler’s largest cost item was maintained in heterogeneous IT systems. Data had to be exported from the ERP system and then processed remotely in complex procedures with database and spreadsheet programs. This approach resulted in a high level of effort for calculating material requirements, which inevitably led to the necessary cycles being extended. With annual material costs of around €7.6 million, inventory values of more than €1.5 million were pushed forward, which was considerable in relation to the throughput times. However, in order to make optimal purchases on the construction element market, with prices changing daily in some cases and a rapid ageing process in relation to the products, daily updated stock requirements are necessary. To make this possible, immediate action was taken at the system interfaces, which resulted in a significant reduction in the effort required to determine material requirements.

In addition to optimizing inventory management, further measures were required to increase productivity. The analysis of the processes revealed that too many business transactions were handled variably. The company is currently working on optimizing its business processes with the support of Abels & Kemmner. This work is also beginning to bear fruit. This made it possible to increase the efficiency of order processing and better utilize the functions of the existing ERP system.

Within 2.5 months, stocks of raw materials were reduced by approx. 13%, stocks of finished products by approx. 20% and stocks of semi-finished products by as much as 48%.

Successful new start

Within two months, the partners involved in the renovation project made the most important adjustments and set the course for the future. In discussions with potential institutional and industrial investors, it quickly became clear that the business plan was viable and that the prospects for success of the restructured company, which had focused on its core competencies and been relieved of unnecessary resources, were positive. With Neways Electronics International N.V., an investor was found that represented the most sustainable solution for the company and its employees, as Neways has a good market position and brings additional orders to the company. The new owner’s goal of improving access to the German electronics market with the purchase of Semecs Neunkirchen also promised a prominent position within the group. The company made a promising new start with 49 employees, less than half of its previous workforce. On the basis of conservative, investor-neutral planning with a “black zero”, the conditions are in place for positive development.

Solid planning always finds investors

The result of the reorganization has shown that companies in crisis situations and even insolvent companies have a chance of survival and can find new investors. Provided that the company’s framework conditions (market, suppliers, customers, value chain, management system) are in place and that it acts consistently and plans seriously. Determining the real situation of a company and its actual future viability involves more than just analyzing past figures through the eyes of an auditor. In addition to financial and accounting restrictions, a company’s future prospects also depend on its market potential and its technical and organizational potential. A business plan must therefore be drawn up “bottom up” from the market based on the resources and infrastructure required to provide the service and must not just be examined “top down”. It is not sufficient to check inaccuracies and errors only on the basis of random samples or plausibility analyses. On the basis of solid bottom-up planning, banks also find it less difficult to provide SMEs with the necessary funding. Our task in restructuring projects is often to support companies in designing such corporate plans. Abels & Kemmner acts as an objective and neutral mediator for the respective negotiating partners, be they insolvency administrators or companies seeking liquidity. This is the only way to gain the trust of all parties involved, which is needed to develop successful solutions and the only way to benefit the parties, as only a resilient business plan will be successful in the long term anyway. So protect yourself from overly euphoric or unreliable planning.

About Abels & Kemmner

Abels & Kemmner GmbH was founded in 1993 by the engineers and economists Dr. Helmut Abels and Dr. Götz-Andreas Kemmner.

The company focuses on streamlining value chains (supply chain optimization) for series and variant manufacturers as well as wholesalers. We deal with the design and optimization of order processing and logistics from suppliers to customers and from article assortment to IT support. Supply chain concepts that we have developed with our customers have already won two best practice awards.

The second focus is on restructuring and earnings enhancement projects. We develop continuation forecasts as well as restructuring and downsizing concepts and implement these in the companies. We have made a name for ourselves in crisis and turnaround management through the successful restructuring of medium-sized companies. In recent years, we have been involved in the restructuring of the majority of major corporate insolvencies in Saarland.

A&K caused a sensation in 1997 when it founded the first virtual company made up of six medium-sized companies from the automotive supply industry.