Operating the right levers

Götz-Andreas Kemmner

The economic situation and international competition require swift action. With the help of market-synchronized value creation, production and retail companies can reduce their inventories, cut throughput times and therefore improve their productivity. However, the necessary fields of action must be identified and the right levers used.

There is a need for action in many production and retail companies, which is partly due to the ever shorter product life cycles. In addition, the increasing number of variants is having an impact on day-to-day business in that the quantities of individual variants are falling. The proportion of suppliers is increasing due to the global division of labor; at the same time, work is becoming ever more closely interlinked. For these reasons, managers today can no longer afford to be inefficient, everyone knows that – and yet rarely is too little done.

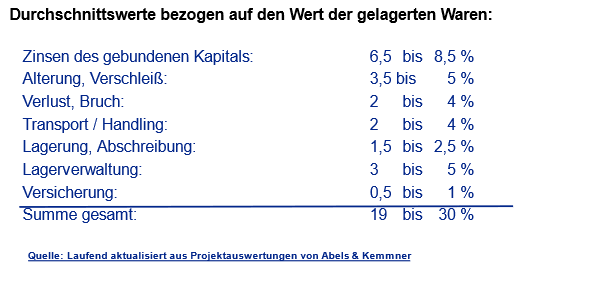

These problems are forcing those responsible in companies to act ever more frantically: Overtime today and short-time working tomorrow. Many company bosses are responding to this with a well-known company remedy – stocks. But inventories are opium for the company: They keep people quiet, don’t solve any problems, but cost a lot of money. Two studies by Siemens and Abels & Kemmner show how much money inventories can cost (table). According to these surveys, 19 to 30% of the average inventory value is wasted each year on warehousing.

Stocks in the company tie up capital that is urgently needed to secure your own competitive position. Stocks at all levels of the value chain are dead capital – at the supplier, at the customer, in the finished goods warehouse, in the Kanban warehouse and in ongoing production.

Making value chains more competitive again

“As we live from the market, we have to address the market with our solutions”. This fundamental consideration requires, first of all, that a company’s employees are able to quickly follow the winding paths of market demand. To do this, we need to look ahead in order to recognize the curves of the market, the fluctuations in demand, as early as possible and thus be able to react in good time. The first field of action therefore concerns sales planning.

Rarely will it be possible to recognize all fluctuations in demand so early that the production or procurement of products can be order-related. It is therefore important to maintain optimum stocks of finished goods and/or semi-finished goods at the various stages of the value chain in order to achieve delivery readiness with the lowest possible inventories. The second field of action therefore includes materials management.

In order to keep stocks low within production, “pulling” control systems are required that only call up material to the extent that it is actually consumed. These circulating stocks must also be adjusted and readjusted in such a way that they enable delivery capability with low capital commitment. Lower inventories also mean shorter throughput times and therefore greater flexibility in production. This opens up the third field of action: production processes and order processing.

However, recognizing fluctuations in demand in good time and responding to them flexibly only works if the suppliers cooperate well. For this reason, it is important to optimize the value streams beyond the company’s own boundaries. The close integration of suppliers into the process chains is absolutely essential in order to keep transaction costs low and avoid unnecessary inventories.

The supplier who offers the lowest purchase price does not always ultimately provide the cheapest product. Purchase prices are only one element of the system costs (total costs of ownership) of a product. This finally brings us to the fourth field of action, supplier integration.

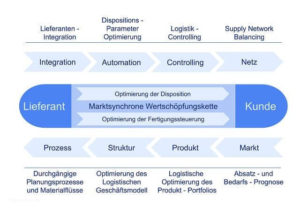

Figure 1 shows the path to a market-synchronized value chain based on the aforementioned fields of action.

Sales planning and forecasting

The best thing would be if you didn’t have to plan at all, because all products can be procured or manufactured on demand. However, this is pure wishful thinking and cannot be fully realized in any value chain. If you follow your own value chain upstream, you will eventually reach the point where the remaining lead time is longer than the delivery time that can be achieved on the market. In technical jargon, this point is referred to as the logistical decoupling point. At least at this point, you will have to live with stocks. If stocks are required, you have to plan so that you can achieve delivery readiness with the lowest possible stocks.

Correct sales planning requires a closed planning cycle that is run through monthly, for example. In order to build an effective planning cycle, it is important to observe design criteria. This includes the separation between strategic planning (at a highly aggregated level) and operational planning (at item level). Strategic planning is used to determine the “route” for production and procurement. It is very important to structure and hierarchize the product groups correctly.

Another design criterion is: operational planning only for items that are easy to plan. Experience shows that 20 to 30% of all articles can be planned well. A company usually generates 60 to 80% of its turnover with these articles. A production company also utilizes 60 to 80% of its production capacity.

The ABC/XYZ analysis has proven itself in practice for identifying the articles to be planned. While the ABC criteria are used to structure the share of sales, procurement or manufacturing costs, the XYZ parameters describe the predictability of an item. Figure 2 shows an example of the stock distribution of items in the ABC/XYZ portfolio of a glass manufacturer. Figure 2 shows that in the area of C-parts, which only account for 5% of sales, considerable stocks of Z2 articles, which are only sold sporadically, are stored. As a consequence, this means a high level of capital commitment, which only flows out slowly.

For the sales forecast, both consumption data from logistics and the market assessment of the sales department should be used in a planning cycle. Those who follow this approach act according to the design criterion “combination of historical data and market assessment”.

Material management

Correct sales planning is the prerequisite for correct materials management, as sales planning and materials planning are closely linked. In order to keep stocks as low as possible without jeopardizing delivery readiness, two main interventions are required.

Dynamic simulation for the selection of forecasting methods

Identifying the right forecasting methods for sales planning sounds easier than it is. Many ERP or merchandise management systems do not have different procedures for sales forecasting. Most systems that have alternative procedures either offer no method or only an inadequate method for selecting the correct item-specific forecasting procedure. It is not enough to use historical data to check which forecasting method came closest to the later “truth” with its results. Instead, a complex dynamic simulation is required, in which a whole range of logistical parameters are incorporated and measured, including the required delivery readiness level.

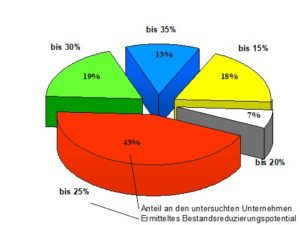

The result of this shortcoming is excessively high stock levels and insufficient delivery readiness. One study found that 82% of companies could reduce stock levels by more than 15% while maintaining or improving delivery readiness (Fig. 3).

Forecasting methods and safety stocks

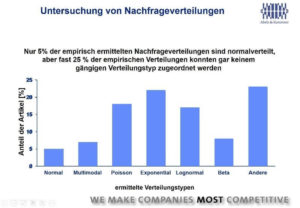

Most of the calculation methods commonly used for demand forecasting and inventory planning (mean value, exponential smoothing, etc.) assume normally distributed demand quantities per time unit. In practice, however, there are different distributions of outsourcing. In a study carried out at RWTH Aachen University, the proportion of normal distribution observed was only around 5%. In contrast, a relatively large proportion of the observed statistical outsourcing distributions (around 25%) could not be assigned to any of the theoretical distribution types investigated (Figure 4).

If demand quantities of an article are not normally distributed, a demand forecasting method that assumes a normal distribution will at best arrive at a correct forecast result by chance, but will calculate this with three decimal places, supposedly precisely.

The uncertainties naturally associated with forecasts are attempted to be cushioned by safety stocks. Safety stocks are also influenced by the distribution of demand quantities for an item.

Now the practitioner does not have to worry too much about whether a forecast or safety stock procedure complies with statistical laws – the main thing is that it delivers the right results. Unfortunately, practice shows exactly the opposite, as Figure 5 shows using the example of AX articles from a textile manufacturer.

Exponential smoothing, one of the standard methods for forecasting, is the correct method for only a third of the articles. But only if you are in rd. 13% of cases instead of the sliding MAD as a safety stock procedure.

Conclusion

Beyond poor economic policy conditions and growing international competition, it should not be overlooked that most companies are still a considerable distance away from market-synchronized value creation. There is therefore still plenty of unused potential for improvement. To leverage this potential requires increasingly differentiated mechanisms that are not even being considered in less developed economies. This in particular is a decisive competitive advantage in high-wage countries, provided that management is prepared to seize its opportunities.