Supplier management at Montblanc

As part of a supplier relationship management project, Montblanc has put its supplier development on a systematic basis. This is a fundamental further development of the supplier assessment system developed by Abels & Kemmner and the Rapid Plant Assessments developed by Raymond Eugene Goodson at the University of Michigan over several years, which is now referred to as RPA-II.

Be it gemstones from Idar-Oberstein or South Africa, jewelry parts from Pforzheim, polished lacquered parts from France, leather from Italy or precision turned parts from Germany and other European Union countries. An international company like Montblanc needs many different suppliers in order to manufacture and supply a wide range of high-quality writing instruments, leather goods and jewelry.

Montblanc’s performance therefore depends not only on the efficiency of its production facilities in Hamburg, Offenbach and Le Locle / Switzerland, but also on the performance of its suppliers. In order to keep pace with international competition, it is important to systematically seek out the best and to further develop our joint capabilities and integrate them seamlessly into Montblanc’s value chain. Today, this is the goal of Montblanc’s Supplier Relationship Management. Sustainable supplier relationship management only works if it is approached systematically and not attempted through occasional efforts.

In January 2004, Montblanc-Simplo GmbH commissioned Abels & Kemmner to set up a systematic supplier management system. The focus of the project was on providing suitable tools to make the selection, further development and integration of suppliers faster, more efficient and more systematic.

In the course of 2004, the consultants further developed a series of tools for supplier evaluation, adapted them to the needs and organizational processes at Montblanc together with the purchasing staff and coached the employees in their systematic application. Today, all new suppliers are subjected to a SWOT analysis in order to systematically identify the strengths, weaknesses, opportunities and risks of future collaboration at an early stage. A supplier strength analysis was developed on the basis of strategic criteria. Today, this analysis helps to derive the right cooperation strategies for different suppliers.

Customized valuation

A supplier competitiveness assessment (RPA-II) developed specifically for Montblanc is of central importance for the further development of the performance of A suppliers and certain B suppliers. This is a fundamental further development based on a supplier assessment system developed by Abels & Kemmner and the Rapid Plant Assessments developed over several years by Raymond Eugene Goodson at the University of Michigan, which was officially presented for the first time in Harvard Business Review in May 2002. The costs for adapting such an evaluation scheme to company-specific requirements, including fully configured software files for the evaluation, are in the four-digit euro range and are not only affordable for large companies.

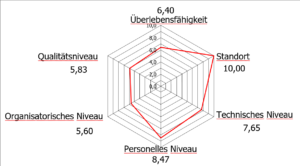

Depending on the importance of a supplier, it is evaluated once or twice a year using this supplier evaluation system. Based on the main criteria of viability, location, technical, personnel, organizational and quality level of the company, the supplier receives information on how to further improve its competitiveness. In regular supplier meetings, known as quarterly meetings, measures that have been introduced are followed up.

The RPA-II evaluation catalog consists of 6 main criteria with 22 sub-criteria, which have up to 11 values. The main criteria include the areas of viability and location of the company, the technical, personnel and organizational level of the company and the quality level of the company. In terms of quality level, emphasis is placed on “quality capability”, while formal quality certifications have little influence on the assessment. This is due to the fact that most companies already have processes in place to evaluate the product and delivery quality of suppliers. Good or poor performance on the part of suppliers should not be judged twice at this point.

The six main criteria are broken down into the following sub-criteria:

- Survivability:

Creditworthiness index, dependence on individual company resources - Location:

Distance from the product development area, country risk according to various evaluation criteria - Technical level of the company:

Technical scope of services, technical performance status, changeover flexibility, CAD/CAM coupling, material flow and space utilization - Personnel level of the company:

Professional competence, personnel flexibility, motivation and employee qualification Cleanliness and tidiness, customer orientation - Organizational level of the company:

Complexity management and flexibility, supplier integration, internal organizational processes, customer integration, production planning and control, visual management, - Quality level of the company:

Quality management of the supplier.

Audit procedure

Normally, the auditor – at Montblanc these are usually the technical purchasers – prints out a blank evaluation catalog. This allows him to work comfortably on site without having to rely on a laptop. Back at his desk, the auditor enters his assessment into the system. He can currently switch back and forth between an English and a German version. Additional languages can be added without any problems. In this way, he can, for example, work with a German entry catalog, enter the evaluation in German into his system and print a report for the supplier in his language.

If the audit is carried out by several people or by an experienced auditor, it has proven to be advantageous to keep your eyes open and your pens closed during the supplier visit and the factory tour, i.e. not to act like a surveillance officer. The continuous entry and ticking off of criteria distracts attention from the operational events. The criteria are therefore specifically structured and described so that the audit protocol can be completed after the visit. Even inexperienced users can make reliable statements when several employees evaluate together.

The result of the audit leads to an overall score, which can be a maximum of 10.00 points, and also to a performance profile for the individual assessment criteria. The overall score makes it possible to track the further development of Montblanc’s supplier pools on the basis of a key figure. Based on this detailed profile, the supplier can recognize where he does not yet sufficiently meet the Montblanc-specific requirements.

The purpose of the audit is not to prescribe the measures to be taken by suppliers. It is up to the management to decide which specific measures the evaluated company wants to implement in order to eliminate the deficits identified. On the other hand, however, the supplier’s management must indicate to Montblanc which measures are to be introduced and within what timeframe.

Depending on the importance of a supplier, supplier meetings are held two to four times a year. A standard item on the agenda of these supplier meetings is a discussion of the measures taken to date and the successes achieved. In this way, supplier development is consistently pursued and driven forward.

In the luxury goods industry, it is not only brands that are in competition, but also their supply chains. Just like in soccer, you win together and lose together. In order to win the game, it is therefore important to create the right interplay with supplier integration and an optimal set-up; a step that the consultants are currently working on.

Hans-Hubert Hatje,

Group Purchasing Director of Montblanc, is responsible for the purchasing activities of the Montblanc Group

Dr. Götz-Andreas Kemmner,

Co-founder of Abels & Kemmner, a consulting firm whose focus includes streamlining value chains

Supplier Relationship Management

A few years ago, all the attention was focused on optimizing internal processes. The aim was to overcome the interfaces between the operational areas in favor of the overall process. Many companies have made considerable progress in designing “end-to-end business processes”. However, process integration does not stop at the factory gates. An efficient supply chain also integrates customers and suppliers. All activities for maintaining the supplier base and integrating suppliers into the value chain are now referred to as supplier relationship management.