The “Efficient Customer Response” concept of Schott-Rohrglas GmbH

Csaba Debreczeny; Konrad Ernst; Armin Klüttgen1

The “Efficient Customer Response” concept, with which Schott-Rohrglas plans to meet a three-day delivery time in emerging markets such as TFT flat screens 98 percent of the time – and this with a production and transportation time of more than four to six weeks – was developed with the support of Abels & Kemmner.

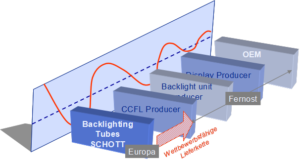

The “Backlighting” division of Schott-Rohrglas GmbH manufactures glass tubes for “Cold Cathod Fluorescent Lamps” (CCFL) from special types of glass. These high-tech fluorescent tubes are used as light sources in scanners, among other things, and are installed in so-called backlight units, which are the light source for the colorful and high-contrast display of the TFT displays. TFT displays can be found in the latest televisions, flat screens for PCs and laptops, but also in navigation systems and medical diagnostic devices such as 3D ultrasound. The market for these and many other flat panel applications has seen strong growth in recent years. Every year, new “fabs” are built in which even larger screens are produced at even lower cost and with even more advanced technology.

Suppliers such as Schott-Rohrglas who want to survive in such highly dynamic markets must meet the highest customer demands: They must always offer the best quality, short delivery times, absolute readiness to deliver and a high degree of flexibility in terms of delivery quantities and product characteristics due to technological change. This is a challenge for companies at a stage of the value chain such as glass tubes for TFT backlights, as they have to contend with the so-called bullwhip effect at the end of a multi-stage supply chain: even slight fluctuations in market demand (for navigation systems, for example) can have a whiplash effect on upstream production and order volumes.

Another factor for Schott tubular glass is the location: displays are not manufactured at Schott’s sites in Mitterteich in the Upper Palatinate or in the Czech Republic. The entire market is currently located in the Far East (Korea, Japan, Thailand, China). The production facilities of all direct competitors in the Backlighting division are also based in the Far East and are therefore much closer to the customer locally. The main challenge for Schott tubular glass is therefore the extremely long transportation time of four to six weeks from Europe to Asia. Nevertheless, despite the comparatively higher logistical and therefore also financial burden, Schott-Rohrglas has so far performed very well thanks to its adequate positioning in the market and good local sales offices, and intends to continue expanding in the emerging market for flat panels.

In addition to the high product quality and local sales presence, a 98 percent guaranteed delivery time is crucial for this. With a transportation time of four to six weeks, this requires a particularly efficient and differentiated supply chain and needs-based product stockpiling, as JIT production to order is understandably ruled out. Supply chain management requires a differentiated calculation model with which the supply chain can be regularly readjusted in order to be able to react to strong fluctuations in demand in good time. This model was to be developed as part of a project and answer the following key questions, among others:

- Which material should be stored where, in what quantities and with what degree of processing?

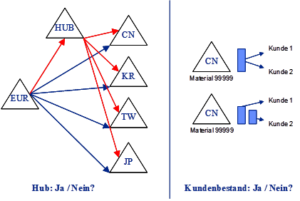

- Under what conditions does it make sense to interpose a central distribution hub in Asia between Europe and the regional warehouses in Asia?

- How should the stocks of a material with the same degree of processing then be distributed between Europe, the optional new hub and the regional warehouses in Asia?

- Should a material in a warehouse also be planned on a customer-exclusive basis and therefore as an independent stock?

- How can the forecast be improved?

The “Efficient Customer Response” model developed by Abels & Kemmner for Schott-Rohrglas, which can simulate all relevant scenarios and enables rolling updates for the future, is intended to provide answers to these questions in future.

Uncertainties and restrictions

The following aspects are particularly difficult to control in the situation of Schott tubular glass:

- Preparing a good forecast is made more difficult by the fact that the overall display market has been undergoing an increasingly dynamic transition from CRT to TFT devices for several years. It is therefore very difficult to determine how quickly and where which fluorescent tube in which product group will develop.

- The consideration of historical consumption alone for the preparation of forecasts is not sufficient to describe the future, as the change from CRT appliances to flat screens represents a structural change that hardly allows the use of predecessor-successor relationships.

- The development of new types of glass with different properties is a parallel process that also has an impact and therefore represents a further dimension of forecasting uncertainty.

- Customer orders vary greatly in terms of quantity and deadline, and it sometimes happens that a customer changes attributes in the specification of the ordered material (e.g. glass type or length) in the course of product modifications to improve quality or reduce prices, or for the purpose of optimizing production, without giving long-term advance notice. In this respect, even orders cannot always be reliably produced in advance according to call-off orders.

A precise forecast is a difficult task under these conditions. However, this is necessary if production, which does not always deliver quantities in line with the pull principle due to the special features of the manufacturing process (melting) of the glass material, is to be controlled on the basis of forecasts.

So how can Schott’s offer to the market to deliver in 3 days still be implemented? And this with a transportation time of four to six weeks to Asia? A seemingly unsolvable problem at first glance, which is nevertheless to be solved by new modeling:

…are answered by the “Efficient Customer Response” model: Does a central hub in Asia make sense or not and does it make sense to keep customer-exclusive, i.e. special customer inventories to ensure delivery readiness and therefore also to plan independently?

The solution model

As part of a value stream analysis, the logistics processes were first recorded and the logistics requirements generated by the market were defined. After defining and providing the required data, a spreadsheet model was developed that analyzes historical data and processes the forecasts created. The two views are linked to each other via adjustable tracking signals in order to provide appropriate information in the event of very large deviations or a diminishing effect of the structural break, enabling targeted intervention. The model simulates the effects on both the inventory and the distribution costs of different, adjustable scenarios. Variations can be made, for example:

- Target delivery readiness

- Lead time

- Specification of shelf life according to XYZ indicator

- Central Asian hub (yes/no)

- Customer-specific stocks of a material in a warehouse (yes/no)

Based on historical data, target and safety stocks, target ranges of coverage, inventory costs and XYZ indicators are determined by means of a forecast calculation. At the same time, the forecast figures are used to determine a second target stock and costs from the planned consumption per material via a range of coverage specification.

Different tracking signals indicate to the planner where past consumption deviates beyond certain limits from the forecast consumption. A deviation of the target stocks from the two different views is also displayed in various gradations.

In this dual system of target stock calculation, the results from the forecast analysis are leading the way in the current phase of structural change. The tracking signals indicate excessive deviations from past consumption and show the extent to which the structural break has turned back into regular consumption behavior.

Results of the project

For each material, it is now possible to determine how much needs to be kept in which warehouse in order to ensure 98% readiness for delivery if the “delivery 3 days from order” requirement is met.

The question of whether or not a central Asian hub should be set up was answered in the negative. The hub only has a marginal effect on stocks, but leads to significantly higher expenditure and therefore higher costs in administration and logistics.

Customer-specific stocks are only set up where absolutely necessary. Although these increase the planning effort, their impact on existing buildings is also not significant.

In addition, the model offers the possibility of generating valuable indications of standardization potential by setting attributes (e.g. replacing glass type A with glass type B). After replacing an attribute or several attributes simultaneously, the simulation delivers the effects on consumption regularity and stock or stock costs as a result.

In parallel with the above results, a new demand planning process is being introduced to improve the quality of the sales forecast. The quality of the forecast is then measured by implementing suitable KPIs (Key Performance Indicators) in order to achieve even better forecasting and therefore planning accuracy in the future.

Thanks to the support of Abels & Kemmner, the model for ensuring “Efficient Customer Response” is currently being implemented quickly and will then provide reliable data for managing the supply chain of the Backlighting business unit. With the completion of the new demand planning process, the target delivery readiness level of 98% within three days can be met even more reliably without unnecessarily driving up stocks. This is because there is a high risk that these inventories will have to be written off due to technological change. At the same time, this project, which shows great potential, will also be an example of how Asian companies are not the only ones capable of supplying other regions of the world competitively from their home country.

1 Dipl.-Ing. Dipl. Ök. Csaba Debreczeny is General Sales Manager Backlighting, Dipl.-Ing. Konrad Ernst is Head of Logistics/Informatics at Schott Rohrglas GmbH in Mitterteich, Dipl.-Kfm. Armin Klüttgen is Senior Consultant at A&K.