When investors buy companies, they also look for the liquid funds required for the restructuring that is often necessary in the new company. There is often great liquidity potential in excess inventories.

by Armin Klüttgen1 and Thomas Körfer2

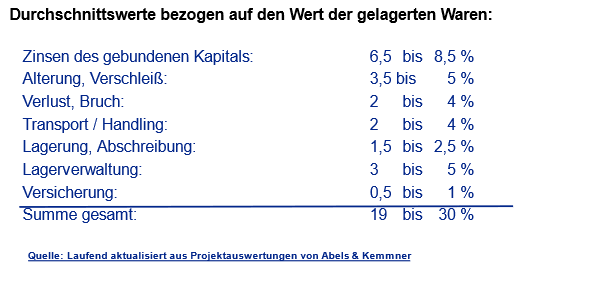

Reducing them creates interest-free liquidity, promotes market orientation and also optimizes the company’s net asset value. Abels & Kemmner carried out a corresponding potential analysis for an investor in the automotive supply industry within 14 days. The result: around 20 % of the planned investments can be made by the company itself through inventory reductions alone.

The rapid scan carried out at “Alpha GmbH” – an automotive supplier with several internationally distributed production sites and country representatives – differed from a classic logistics potential analysis in that the project was carried out at an unusually high speed and intensity. Within 14 days, the value chain, logistics business model, customer structure, sales planning and product structure had to be analyzed. The market situation, the planning and scheduling processes and the quality of the data sources were also analyzed. Just 13 calendar days passed between the start of the project and the day of the final presentation.

OBJECTIVE: RELEASE AS MUCH LIQUIDITY AS POSSIBLE

The existing requirement of the project was to present a concept in the short term with which the existing inventories could be significantly reduced by the end of 2010 in order to be able to use these liquid funds to finance as much of the investment as possible from the company without interest. In addition, appropriate short-term measures were to be implemented in the final weeks of 2009 to initiate a corresponding development and achieve initial reductions in inventories in order to finance an expiring credit line without interest. In addition to the sustainable improvement of planning and scheduling, special measures were therefore developed for items that have experienced a structural break in consumption behavior due to the current economic crisis.

HIGH-PRECISION RESULTS IN THE SHORTEST POSSIBLE TIME

In order to be able to provide all the necessary data in a correspondingly short time, the data and process analysis were carried out in parallel. In addition, several inventory driver workshops were held at short notice in order to be able to respond quickly and effectively to the sometimes very high individual inventories. In reorganization processes, it is necessary to create new structures quickly. This requires consultants to be proficient not only in inventory management but also in reorganization processes, as these involve quick top-down decisions that often lead to parallel project steps and decisions and demand a high level of skill and sufficient routine from the responsible project manager. With its two pillars in both the refurbishment and portfolio management business, A&K was therefore an ideal partner for this project.

THE RESULT

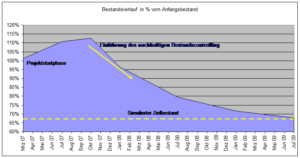

Defensive calculations of the rapid scan showed 26% sustainable inventory reduction potential that can be achieved within one year. Liquidity potential amounting to around C 100,000 was also identified during the portfolio driver workshops and released on the same day. The expiring credit line could thus be cushioned completely by the company itself.

RAPID SCAN DAY 1

On the first day of the project, the DISKOVER SCO simulation software was connected to the productive SAP system within a few hours, enabling all relevant and current data to be recorded for the analyses to be carried out. At the end of the day, the results of an ABC and XYZ analysis were already available and initial findings on consumption regularities and the ability to plan individual items as well as existing stock structures were revealed. Parallel to the preparation of the first data analyses, the process analysis also began on the first day, which provided an overview of the situation as well as specific tasks and problems “upstream” through the entire value chain, starting from the market and ending with the suppliers.

RAPID SCAN DAY 2 – 8

The parallel data and process analysis practiced in the project from the outset was consistently continued. As part of the stock driver workshops, the project team works out the causes of overstocking.

The inventory driver workshops explored the story behind each individual item, with preliminary data analyses in SAP and DISKOVER SCO identifying the items that require closer examination. Possible measures to reduce excess stocks and avoid such situations in the future were also developed. Key portfolio drivers at Alpha GmbH were, for example:

- partially incorrect disposition methods

- Incorrect preliminary planning and no monitoring of the preliminary planning

- No end-to-end planning process from sales planning to purchasing

- Customer-supplier relationship between own locations with bull-whip effect

- No harmonized batch sizes

- Restart process not clearly regulated

- Data quality in the ERP system

- Rudimentary use of existing possible system support

- Project business in which promised start dates are postponed or quantities are reduced or withdrawn completely

Overall, these and other inventory drivers had led to unsatisfactory stock turnover rates and inventory ranges in the past. The need for action in the short and medium term became clear.

RAPID SCAN TAG 9- 72

In the last third of the rapid scan, the aim was to translate the results of the simulations and the findings from the process recordings and inventory driver workshops into recommendations for action and measures as quickly as possible. The simulation showed an overall reduction potential of approx. 26 %. However, it would have taken too much time to reduce the inventory through normal consumption alone. In order to achieve the overall reduction in inventories by the end of 2010, the concept therefore provided for an extensive catalog of short-term special measures in addition to improved planning strategies and scheduling methods with a medium-term effect.

The examination of conversion options for existing products was particularly important here.

In addition to the special measures, further activities were initiated to achieve a sustainable reduction in inventories. The main topics were:

- Strategic measures: Review and optimization of the logistics business model

- Process optimization: improvement of sales planning and scheduling

- Method and parameter optimization: Creation of decision tables for scheduling parameter optimization

- Products: logistical optimization of the product range

- Effort and process efficiency: Improving system support and knowledge of correct system handling

- Employee qualification and motivation: expansion of employees’ planning and management expertise

RAPID SCAN DAY 13: THE CONCEPT

The packages of measures listed were incorporated by A&K into the overall concept of a sustainable, lean solution for releasing unnecessarily tied-up cash and cash equivalents. This encompasses all three directions of systematic inventory management (see illustration).

CONCLUSION

By combining experience in reorganization and restructuring with expertise in portfolio management, A&K is able to implement such projects, which under “normal conditions” might take 3 months, within 14 days. 26 % inventory reduction potential and € 100,000 immediate reduction also speak for themselves.

1ArminKlüttgen is Principnl at Abels & Kemmner GmbH.

2ThomasKörfer is a consultant at Abels & Kemmner GmbH.

The name of the company was changed to Alpha GmbH to protect legitimate expectations.