Material costs are rising faster than companies can improve their material efficiency: This is shown by simple comparative calculations over the last 10 years.

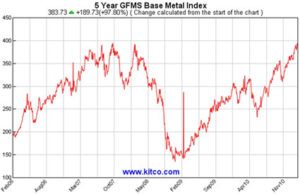

A look at the GFMS Base Metal Index shows that raw material costs rose by 50 % between January 2000 and the recession month of January 2009, i.e. an average of 4.14 % per year. In relation to the index value of December 2010, the increase even amounts to 14.73% annually.

Many companies are unable to pass these price increases on to the market in full or compensate for them through cost savings. We do not have any statistically reliable data on the extent to which companies were able to compensate for the price increase in the same period through improvements in material efficiency. However, perhaps the data from the German Material Efficiency Agency (demea) can provide initial indications of the average material efficiency potential that is being exploited today: On the basis of 663 analyses on improving material efficiency, which were funded by demea, the experts determined an average improvement potential of 2.4% (median 1.1%!), based on turnover. Depending on how you do the math, this corresponds to a maximum potential reduction in the proportion of material costs of 5.9%1 – as a one-off effect.

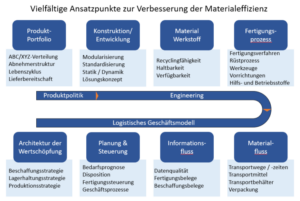

In the long term, however, this is not enough to compensate for the price increases. After all, raw material costs will continue to rise significantly over the long term. The demand for raw materials is not only growing dramatically worldwide. Access to raw materials, beyond crude oil, is also increasingly becoming a power factor in global competition. China is already starting to play this out. Manufacturing companies will have no choice but to work massively and continuously on improving their material efficiency. Companies are still in the process of harvesting the low-hanging fruit. However, the spectrum of starting points is much broader than is usually assumed and there is still a lot of potential that can be exploited. You can see the main starting points in the graphic below. We will be happy to help you identify the positioning letters that you need to adjust in the future.

Further information on this topic can be found here:

- Case study: “Peak” value creation: Material efficiency at Anita Dr. Helbig GmbH increased by 29

- Material efficiency (not) an issue?

- Funding for projects to improve material efficiency: Current funding information

Footnote:

1 Calculation scheme: 2.4 % in relation to sales (=100 %) corresponds to approx. 5.9 % of material costs (=40 %).