In the last issue of POTENZIALE, we showed you some initial steps in the first part of our best practice article on product portfolio management: among other things, we explained why a “CZ explosion” occurs in most companies at some point and why regular monitoring of the four most important inventory dimensions ABC, XYZ, STU and ELA can help prevent this. We have also already talked about the exotics in the product portfolio. Exotic products are sold in small quantities and therefore have low stock throughputs. The vast majority of exotic products are therefore in extremely irregular demand and therefore fall into the CZ and CZ2 classes of the product portfolio. If you look at the composition of a product portfolio over the years, you will see that the number of items does not increase evenly across all portfolio areas, but rather increases primarily in the CZ and CZ2 areas. This is not surprising, as every new product begins its life as a CZ2 or at least a CZ item. If it is successful on the market, it will develop into an AX article in the best case, but at least move out of the CZ/CZ2 corner. Unfortunately, the natural laws of the market mean that very few articles are successful. The majority of all articles never find their way from the depths of the product portfolio to the heights of market success. As a result, the product portfolio is enriched with articles in the CZ/CZ2 area to a disproportionately high degree. We already talked about the problems involved in calculating the costs and therefore the price of an item at the beginning. The calculation problems tend to lead to CZ and CZ2 articles being underestimated in their actual costs and AX articles being overestimated in theirs. This calculation distortion can be easily visualized using the example of sales. Many of us are familiar with the star salespeople in our companies who are responsible for important key accounts or who sell dominant products. In addition to these few stars, a large number of hard-working salespeople often fight on small-scale product and customer fronts. While the supposed stars hardly sell anything but have to make a note of what quantities their customers want, the rest of the crowd make a real effort to bring the famous “sour beer” to the people. All too often, the total costs of distribution are only allocated according to “carrying capacity”, which means nothing other than that they are added to the product costing in proportion to sales. For example, 20% of the best-selling items quickly account for 80% of the total distribution costs. What happens as a result is something we see time and time again in business life and in practically all sectors: If there are too many CZ and CZ2 articles, the AX articles have to be sold at too high a price. This enables competitors to break into the AX article segment with cheaper offers. The food discounters in Germany provide the classic example of this development. Over the years, they have taken market share from traditional retailers. They concentrated on just a few articles: the AAXX articles of daily life. This enabled them to structure their value chain cost-effectively and buy in large quantities with corresponding discounts. Traditional retailers offer a wide range of other products, including many truly exotic items, in addition to the bestsellers on the discount market and, in order to finance this, have to sell their bestsellers at a higher average price than the discounters. Do you think this is a special case in retail? If we look at developments in the German or Swiss machine tool industry, we can see a similar effect. In the sixties and seventies of the last century, the machine tool industry was proud of the customized special solutions it was able to offer thanks to its engineering advantage over the emerging Japanese competition. Which customer would want “butter-soft” lathes that bent every time a large part was machined and could only maintain small manufacturing tolerances? However, the buttery-soft Japanese lathes were cheap because the manufacturers concentrated on standard machines – probably more due to engineering deficits than market strategy considerations. Perhaps not so surprisingly, many customers needed these butter-soft machines. They were quite economical for small, less demanding parts. Japanese manufacturers opened up the world market by leveraging such unexciting bread-and-butter machines. The Central European machine tool industry only regained market share when its engineering expertise enabled it to build its products according to modular principles and thus closely combine standard and customer-specific solutions. The AX portfolio is the typical point of attack where new competitors break into existing markets. For this reason, best practice building block 3 is: Successful companies keep their portfolio raft in balance. If a company wants to go down the path of streamlining its product portfolio, it must not be afraid of the spectre of product range constraints, as Basic Principle 4 states: Product range constraints are the blinkers of product policy. If one economic party forces another to purchase or supply not only the products desired by the other party, but a more or less defined broader product range, then this is known as product range constraint. Product range constraints are found on the supplier side, primarily in the business-to-business sector. Compulsory assortment can be exercised by a supplier who forces its customers to purchase a complete assortment or by customers who demand that a supplier also provide rare and irregularly required articles in addition to the articles they require regularly and in large quantities. A product range demanded by the customer is rarely contractually fixed, but is understood by the sales department as a service or is provided in anticipatory obedience. From the point of view of product portfolio management, the customer’s product range constraints play an unfavorable role. Genuine assortment constraints imposed by the market or explicit customers must be handled with extreme caution, yet we regularly find that assortment constraints are one of the most overrated criteria in product portfolio management. This sounds very daring for a logistics specialist. However, product range constraints are not a nebulous matter, but can be statistically recorded and scrutinized:

- When product A was purchased, how often was product B also purchased?

- If product B is often purchased with product A,

- Couldn’t product C be offered instead?

- Is it then a compulsory connection for the customer or just a collective order?

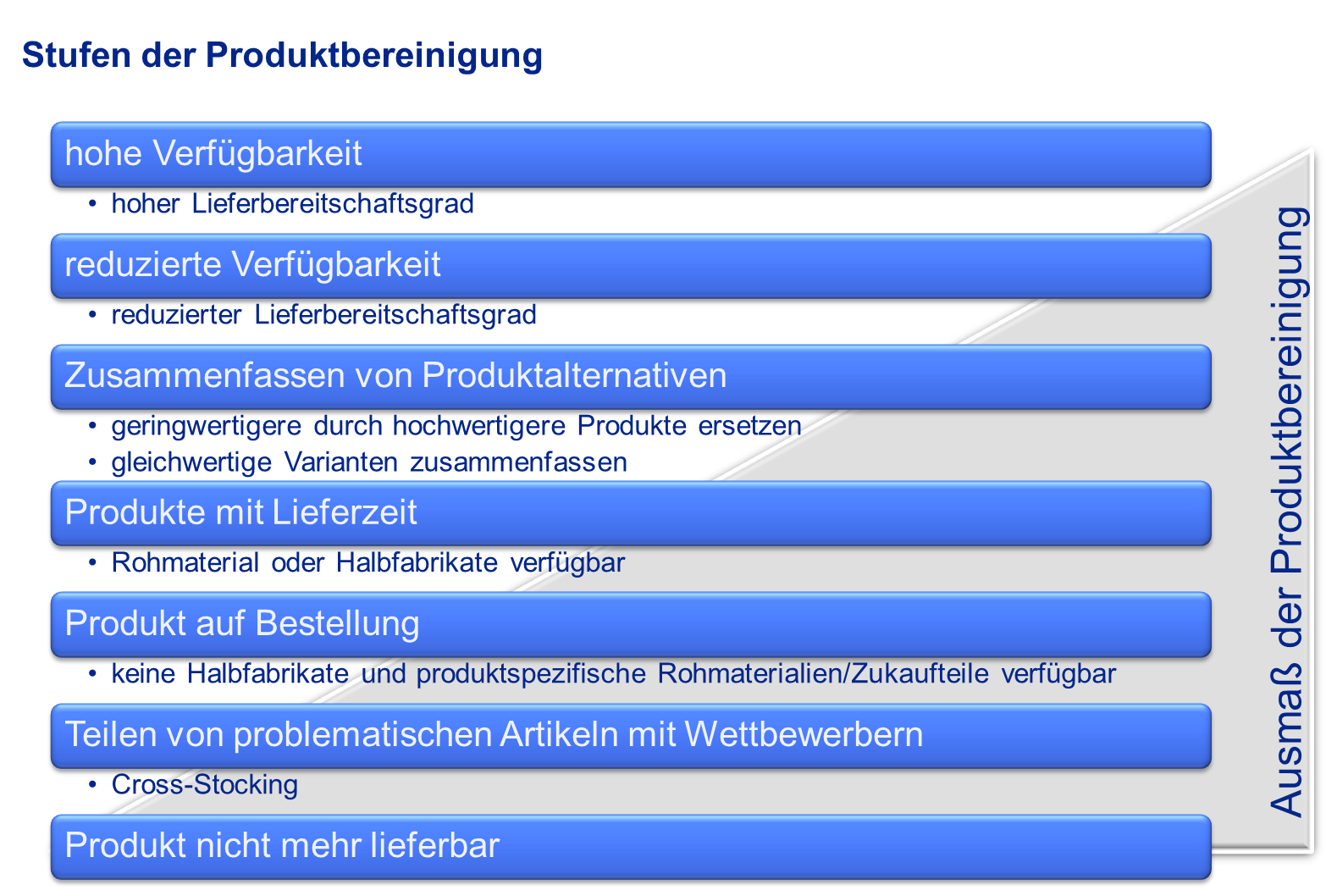

As important as product range constraints can be in individual cases, they are unimportant in many other cases of product range policy. If a company were to design its product portfolio solely according to the supposed product range constraints of its customers, all of the company’s problems would dissolve in insolvency in the medium term. The product portfolio is determined by a whole range of other criteria, both strategic and economic. Ultimately, money must be earned with the current product portfolio, which is why no one can close their eyes to the contribution margins of the individual products. Economic constraints continue to be exerted by the safety stocks required to keep a product at the required level of readiness for delivery. The residual stocks that would remain if a product were to be disposed of in the short term must also be taken into account when streamlining the product portfolio. It is more difficult to part with items with a high share of sales than with items with a low share of sales, even if they only have low contribution margins. This is not least because they can be important for the perception of a company on the market and also hold great earnings potential if contribution margins can be improved. From a strategic point of view, it is important to ensure that the articles are distributed over the entire product life cycle: at least in the case of high-margin articles, it is better to have a left skew (more articles for the new product launches) than a right skew (more articles for the discontinued products). For this reason, we can state best practice building block 4: Six central criteria determine whether an item remains in the product range. Only one of these is the assortment constraint. Anyone who has ever been involved in discussions about streamlining a stock manufacturer’s product range knows how intensely the sales department in particular defends the exotic products in the product portfolio. The easiest way to do this is to link the launch of new products to the disposal of old ones. A sales organization that earns money from every fish it catches and does not have to pay for the fishing itself is behaving completely consistently when it resists streamlining its product portfolio. For this reason, the aspects of reintroduction and removal are always seen in relation to each other. Another key reason for the hesitant behavior of sales can be found in Basic Principle 5: When it comes to product streamlining, many companies make decisions like in the Roman circus: thumbs up or thumbs down. If it is only a question of either/or when sorting out products, this is not only painful from a sales perspective, but can also really hurt logistics. This is always the case when a product to be discontinued still has a lot of remaining stock or open deliveries from suppliers, which would leave the supply chain stranded. However, the world of product portfolio management cannot simply be seen in black and white – especially not from the perspective of logistics and supply chain management. Fine gradations are possible between a brightly shining article with high delivery readiness and a darkly disappearing article that can no longer be delivered. For example, you can first consider withdrawing the delivery readiness level of an item. The item is therefore still available, but it will be more common for customers to have to wait for the item to be delivered. In our experience from numerous projects, customers accept this when it comes to exotic items that are either only offered by one specific supplier or are difficult to obtain from all relevant suppliers.

- Best practice rules for product portfolio management, part 3

- Best practice rules for product portfolio management, part 1

- Best practice rules for efficient scheduling

- Best practice rules for efficient sales forecasting