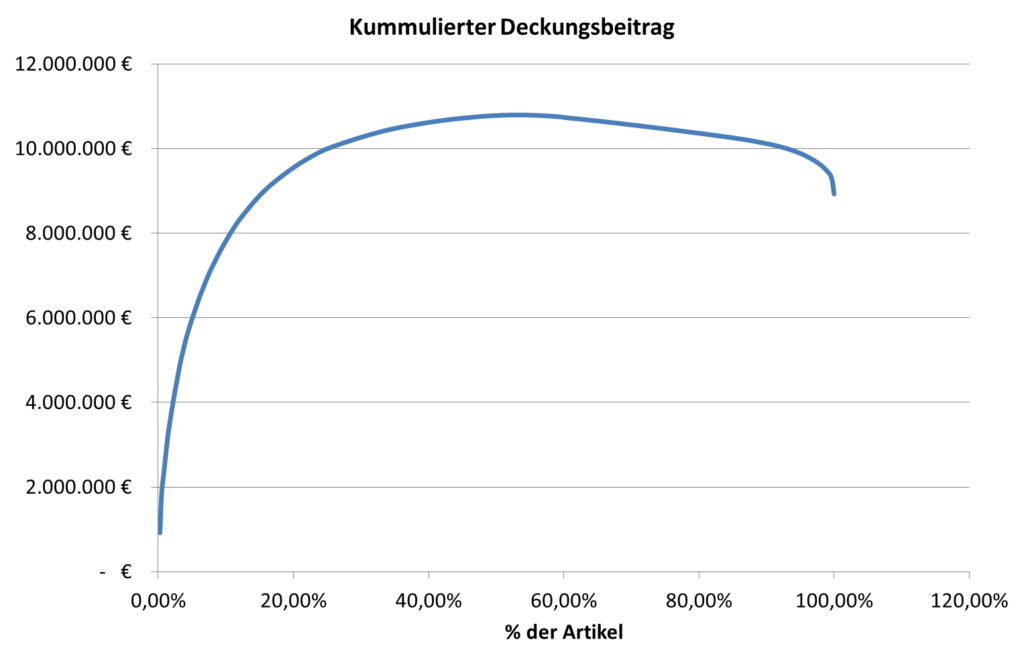

Many, if not practically all, companies are constantly struggling with the consequences of the “CZ explosion”: the diversity of variants in their product portfolio is blowing up in their faces, inventories are rising despite declining delivery readiness, and margins are eroding. In most companies, variant diversity is still seen as the solution to all sales problems. In the following, we will take a closer look at what successful companies are doing in terms of logistics and supply chain management to get a handle on variant diversity. Dealing with the product portfolio is often seen as the domain of product management, sales and marketing. Without wishing to interfere with the responsibilities of these areas, there are good arguments for not ignoring the voice of logistics and supply chain management when it comes to maintaining the product portfolio. This is because supply chain management often has one of the most objective voices in the chorus of emotions that sing about product portfolio management. It sounds terribly boring at first, but it is terribly true: Basic principle 1: A product portfolio costs money – and so does every expansion of it. Every new product incurs costs in development, production and especially in logistics. Logistics performance is a service feature of every product on the market. This applies to products that have already been launched as well as to new ones. We naturally expect the online mail order company, for example, to have the ordered products in stock. What’s more, we expect them to be delivered by the parcel service the next day! However, if we are frequently informed by a retailer that ordered products are not available, we switch to the competition – no matter what great corporate image the marketing and advertising strategists have created. Such requirements have long since ceased to apply only in the business-to-consumer sector. In the business-to-business sector, too, ever shorter delivery times and ever greater readiness to deliver are required. Logistically, the demands of the market mean two things above all: stocks and capacities. If finished products do not have to be kept in stock anyway, at least semi-finished products must be kept in stock, sometimes at high value-added stages, so that they can be completed into finished products at short notice. The former requires high inventories, the latter flexibility in production and transportation capacities and, in any case, both cause costs! The price of a product must also take into account the total logistical costs associated with a particular value proposition. For new products, these logistical costs are usually too high to really be included in the price. In preliminary costing, overhead rates are often applied to the direct costs. These surcharge rates result from corresponding cost allocations from the operating accounts and therefore represent an average value approach. If each individual part carries this percentage surcharge, then these costs are covered. Although this is correct, it does not take into account the fact that the actual distribution of expenses and thus cost causation is not proportional to the direct costs. New and exotic products cause high logistical standby costs in the form of basic requirements and, above all, safety stocks. Both groups often suffer from strongly fluctuating demand and therefore require high safety stocks in order to be able to deliver. Offering new products without being able to deliver them may make the product sexy in some sectors, but in others it makes it a flop. Nobody in a company wants a new product to vegetate in exotic status forever. Instead, the hope is that demand for the product will increase and become more regular, so that future logistics costs will fall. Later, sales, scheduling and – if available – product management check far too rarely whether these expectations have actually been met. If the hopes for product success are not fulfilled, the sales department in particular then likes to point to the product range constraints: this makes it necessary to keep a product in the range that does not cover costs in order not to jeopardize the sale of other, more lucrative items by losing good customers. And so the number of exotics in the product portfolio grows until the critical mass is exceeded and the “CZ explosion”, which we will take a closer look at later, takes its course! At this point, we must note best practice building block no. 1: Every new product requires a “residual lifecycle cost” analysis, which must be updated every three months. The main cost packages that should be under regular, if not continuous, review for new products include the logistical standby costs, the current disposal costs and the development of the real contribution margins. In our experience, it makes no sense to focus on the “total lifecycle cost” at this stage. “Sunk costs, i.e. costs incurred in the past, are no longer relevant for future decisions. Only the costs incurred in the future play a role here. The decisive factor in logistics standby costs is the warehousing costs for the necessary basic requirements and safety stocks across the entire supply chain. Not only inventories at finished goods and component level play a role here, but also inventories that are held by suppliers but financed by the customer. If a product is no longer offered on the market, residual quantities of raw materials, materials, semi-finished products and finished goods occasionally remain, which can only be sold at reduced prices or even scrapped or disposed of as hazardous waste. The balance of these costs represents the disposal costs. Suppliers generally demand acceptance obligations for specific raw materials, drawing parts and product-specific assemblies if these parts are not accepted by the customer within a defined period of time. All of this also counts as disposal costs. Ultimately, the development of the contribution margin must be continuously monitored for each new product. Negative contribution margins may be temporarily unavoidable from a market strategy perspective, but they must be eliminated quickly.

In the next part of the article, which will appear in the 1/2013 issue of Productivity Managenent, you will find out how you can avoid these cross-subsidizations or distribute them more cleverly and escape the assortment constraints.