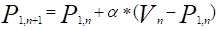

First-order exponential smoothing is a time series analysis method that can be used in materials management to forecast future requirements. With 1st order exponential smoothing, the forecast value of the next time period (P1,n+1) is calculated from the forecast value of the old time period (P1,n) plus the difference between the forecast value of the previous period (P1,n) and the actual consumption of the previous period (Vn) weighted with the help of a present factor α.

If the α value is “0”, then the first-order exponential smoothing does not take into account the deviation between the forecast and the actual value in the previous period and the new forecast corresponds to the old forecast; the actual (current) consumption therefore does not influence the forecast.

If α = “1”, the forecast value of the new time period corresponds to the actual consumption of the previous time period. The actual (current) consumption therefore determines the forecast. In practice, values between 0.1 and 0.5 are usually selected for α.

Our TIP:

First-order exponential smoothing can only be used for items whose consumption shows no trends or seasonalities and whose fluctuations are classified as chaotic, i.e. not following any regularity.

For time series that contain trends and/or seasonalities, 2nd order exponential smoothing is traditionally used.

The general problem with first-order exponential smoothing, as with all classic forecasting methods, is that it assumes normally distributed demand, which is not usually the case in practice.