S&OP (Sales and Operations Planning), sometimes also referred to as SIOP (Sales, Inventory and Operations Planning), is a process that can be found in many companies today. This is always necessary if the identified market requirements cannot be met due to a lack of resources. In most cases, there is a lack of production or personnel capacity and currently often a procurement bottleneck. Sometimes a lack of liquidity also plays a role.

Successful sales and operations planning must overcome four key challenges:

- Ensuring sufficient quality of the input information,

- the design of a process that is as responsive as possible,

- the consistent reduction of existing planning restrictions and

- the consistent use of S&OP results.

Challenge 1:Ensuring sufficient quality of input information for the S&OP process

In order to ensure the quality of the input information for the S&OP process, cooperative collaboration between sales and supply chain management is required first of all. This is not always easy. Sales is generally concerned with increasing sales, while supply chain management focuses on the total costs of the value chain.

As far as future requirements are concerned, the sales department usually thinks in terms of money and product groups and is interested in the long-term trend of market development. Supply chain management, on the other hand, plans in units of individual products or SKUs and is more interested in short- to medium-term changes in demand that are relevant to scheduling.

Forecasts of market requirements are essential

The quality of the input information for a planning process can only be improved by the sales department if it can contribute customer information or its own experience. If no (usable) customer information is available for individual sales items (SKUs), the sales department can only make reliable statements for a few items at best. On the one hand, because he has no information on many articles and, on the other, because the amount of work involved would be too great. It therefore helps to determine statistical default values at the beginning of the S&OP process, which are provided to the sales department at physical product level (SKU level) or further broken down by individual sales channels. If this information is summarized on product groups or product hierarchy levels as sales values, the sales department can enter market trends, which can then be broken down again to the individual physical items in “basic units of measure” (pieces, weight, volume, etc.). In addition, Supply Chain Management requires statements on projects or campaigns from Sales.

Unfortunately, the market information provided by the sales department often does not reflect the actual expected market demand, but is based on budget planning values. In our experience, the larger the company, the more frequently this happens. Unless liquidity is the company’s key resource bottleneck, this is a fatal error for the data quality of the S&OP process and inevitably leads to both lost sales and excess stock and increased scrapping costs.

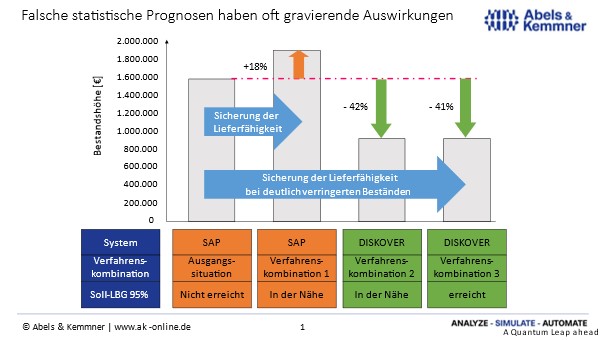

The importance of good statistical input values and careful sales corrections for the result of the entire S&OP process, for the supply chain and for market supply is often underestimated, as the drastic figures from the project at a process manufacturer illustrate(Fig. 1).

Our analyses in this project showed that with the existing quality of the sales forecast, almost 20% more stock would have been necessary to ensure the required delivery capacity. A better statistical forecast alone made it possible to achieve the required delivery readiness with 40% less stock.

Fig. 1: Better sales forecasts lead to better supply chain performance

Get to the point of sale – CPFR helps

The quality of the sales forecast can often be further improved by determining the input data for the forecasts not from the company’s own incoming customer orders but as far downstream as possible, e.g. at the end consumer’s point of sale. However, it is then necessary to coordinate replenishment across the inventory levels from your own to that of the point of sale. A few industries are already trying this in the form of CPFR (Collaborative Planning, Forecasting and Replenishment). In most industries and companies, on the other hand, requirements are passed upstream from one inventory level to the next – from distribution to procurement, as each inventory level wants to remain in control of its own scheduling decisions.

VMI also brings us closer to the market

VMI (Vendor Managed Inventory) solutions with customers can also be a helpful tool for recognizing customer requirements earlier and responding more flexibly. In this case, market requirements are tapped one stock level further down the value stream.

Instead of working together in the traditional way via ordering and delivery, the VMI concept enables the supplier to independently replenish the customer’s stock and frees them from waiting for customer orders and adhering to strict delivery deadlines. This VMI process is usually controlled by a minimum and a maximum stock level, which decouples the supplier from the customer’s order dictates and thus enables more flexible capacity planning. VMI concepts therefore also contribute to greater flexibility when balancing capacities as part of the S&OP process.

Challenge 2: Designing an S&OP process that is as responsive as possible

An S&OP requires a lot of cross-departmental communication and coordination, especially between SCM and Sales. However, this also makes the entire process susceptible to delay effects that slow it down.

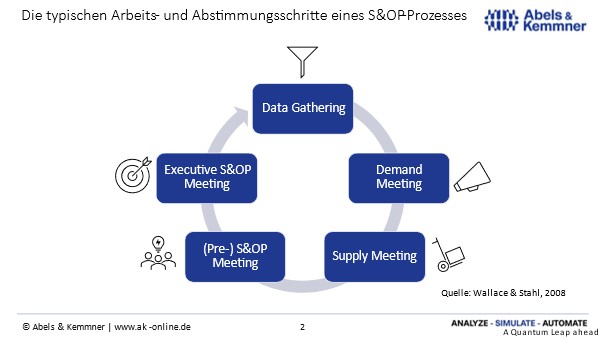

A proper S&OP process takes place on a monthly basis

An S&OP process must be run on a monthly basis in order to be sufficiently responsive; quarterly cycles should not even be started. For this reason, it must be technically and organizationally ensured that the individual process steps follow each other quickly, that the necessary coordination meetings (Fig. 2) are firmly blocked in the calendar of all participants and that all necessary information is available for the meetings. This can only be achieved with adequate system support. An S&OP process is therefore 80% a question of correctly designed software support and only 20% an organizational task.

Fig. 2: The typical steps of sales and operations planning

Frozen horizons are good if they are used responsibly

Increasing the speed of reaction even further by running through the S&OP process on a weekly basis is rarely recommended. There is a great danger of running after every little hook that the market throws. However, plan/actual deviations below the monthly S&OP cycle must be tracked and planning should be adjusted if defined thresholds are exceeded.

People often try to avoid these sub-monthly rescheduling by setting “frozen horizons”. If these can be implemented in practice, this is ideal for reducing the planning effort and, above all, for reassuring production and procurement. From a planning perspective, however, frozen horizons extend the response times and thus the replenishment times to be applied to the items at the inventory level for which the S&OP process is carried out. Higher safety stocks will be required to ensure continued supply readiness. Frozen horizons reduce the need for flexibility (and flexibility costs) in production, at the expense of higher inventories (and inventory costs) downstream of production.

If this correlation is ignored, the ability to deliver will suffer sooner or later and the pressure on production to react more flexibly to customer requirements will increase. If production then gives in, this means that the results of the entire S&OP process are invalidated and replaced by production’s own planning decisions. We euphemistically call this a “broken planning chain”; in fact, however, it means that the S&OP process is at least partially working “for the trash” (see challenge four).

Restrictions and flexibilities must be known and maintained

The speed with which an S&OP process can be completed also depends on how well the restrictions with which you have to contend are known. Existing production capacities should be clearly communicated internally and maintained on the software side so that the software system that supports the S&OP process can work with them directly. It should also be clear which capacities can be expanded, to what extent and with what lead time in order to be able to complete the capacity check step as quickly as possible.

If the delivery capability or production capacity of suppliers is also a restriction to be taken into account, it is just as important to continuously maintain available capacities, possible delivery quantities and current delivery times. There are often framework agreements on the purchasing side that already stipulate the relevant parameters and define the flexibility a supplier must provide in order to follow the fluctuations in the supply chain. Unfortunately, the coordination of delivery flexibility with suppliers is often inadequate.

Example: A specification such as “20% more within 2 months” is not a sufficiently precise statement. Does it have to be possible to deliver 20% more quantity once after two months? Does it always have to be possible to add 20% every two months? Does the delivery quantity have to be increased spontaneously and continuously to 20% additional quantity after two months or is it sufficient if the additional quantity can be delivered at the end of the two months?

Incidentally, the material releases and order horizons required for the desired supplier flexibility are very often underestimated by both customers and suppliers and are coordinated far too tightly.

Challenge 3: Consistent reduction of existing planning restrictions

You should always try to reduce restrictions and not cherish them, which leads to the third central challenge of an S&OP process.

The quality of the results of a sales and operations planning process improves less and less as a result of the increasing mastery of how to deal with the existing restrictions. It is more important to continuously reduce the number of restrictions to be taken into account. Resource bottlenecks increase the planning effort and cause opportunity costs from lost sales and customers; experience has shown that the more restrictions hinder market-synchronized production, the more so.

Fewer restrictions allow for more precise planning

The strategic and entrepreneurial goal must be to continuously reduce the number of planning restrictions that must be taken into account by an S&OP process. Fewer planning restrictions have a positive effect on customer service and sales, while also reducing the effort involved in reconciling resource bottlenecks and enabling more accurate planning results, as you can move from a rough reconciliation to a fine reconciliation.

When fine-tuning at the level of individual materials and individual capacities, a very detailed result is achieved, but if there are several bottlenecks to be considered, you quickly lose the overview and hardly recognize where it makes sense to start with the resource comparison. With many restrictions to be taken into account, it is therefore usually only possible to make a rough adjustment. The restrictions on capacities and resources are compared at the level of product groups or product families and rough capacity groups. The result is inevitably coarser-grained and neither existing stocks nor order backlogs can be meaningfully taken into account.

Planning restrictions in the S&OP process are not a given

All internal planning restrictions, such as capacity or liquidity bottlenecks, are ultimately self-made and this also applies to many restrictions on the procurement market. The acute shortage situation on the procurement markets should not obscure this fact. Single sourcing, for example, may increase your own purchasing power and simplify procurement processes, but it also makes you more dependent on a supplier’s ability to deliver. A large part of the automotive industry’s procurement bottlenecks for computer chips are also home-made, because short-sightedness led to demand volumes being canceled during the downturn of the coronavirus crisis that can no longer be recovered quickly enough. Insufficient coordination of delivery flexibilities with suppliers can quickly lead to compromises having to be found in the S&OP process to meet market requirements.

It does not always make sense to keep your own production capacities so tight that they are constantly overloaded and a compromise between market requirements and available production capacities can only be found with great effort. What applies to automated high-bay warehouses should also apply to production: Above an average capacity utilization of 80% – 85%, performance collapses.

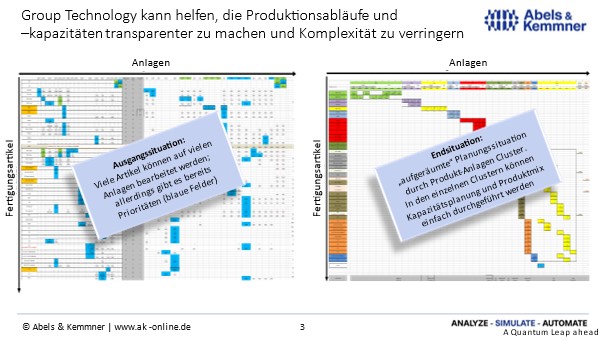

Sometimes we also come across companies that overestimate their own planning complexity. This happens above all when a wide range of production items meets a wide range of production capacities. As many items can be produced on many machines, there is a risk of losing track of them all. The S&OP process is then planned in advance with a reduced available capacity in order to avoid having to constantly deal with capacity bottlenecks in day-to-day business. In such cases, it can help to “tidy up” production using Group Technology (Fig. 3) and form production clusters.

Fig. 3: The complexity of capacity planning can be reduced by forming part families and production clusters. In most cases, this also reduces the effort required for capacity reconciliation in the S&OP process.

Challenge 4: The consistent use of S&OP results

Ultimately, an S&OP process, no matter how simple or complex, only makes sense if its results are used consistently. This sounds banal, but in practice, the decisions made in the S&OP process are deviated from more often than necessary.

Gut feeling is no substitute for jointly agreed planning requirements

When analyzing planning processes in consulting projects, we repeatedly come across operational planners who do not believe the default values from the planning process and try to work on the basis of their own experience and gut feeling. Deviations from the specified planned requirements can also be provoked by the sales department, which exerts pressure on production control.

Lazy compromises are no basis for reliable planning results

Sometimes operational planners have to override the S&OP specifications because the results of the S&OP process are simply unusable. Sales wants to fulfill customer requirements that cannot be met and pushes this through in the S&OP meeting. Production plans with capacities that it cannot fulfill, procurement plans with delivery quantities that cannot be achieved or, conversely, overcaution leads to lower capacities being assumed than are actually available. This usually occurs when lazy compromises are made in the S&OP process because one party pushes through something that the other parties ostensibly accept, but then later try to correct during operations.

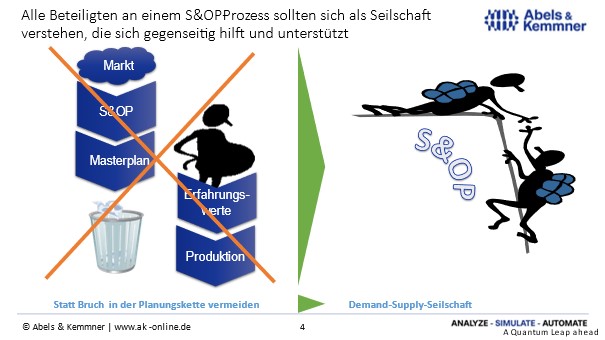

Fig. 4: All those involved in sales and operations planning should see themselves as a team that works together to find the best compromise between the market demand situation and feasible market supply in the interests of the company.

In our experience, the main reason why the measures jointly agreed in the S&OP process are not adhered to is a misunderstanding of the S&OP process (Fig. 4). This is sometimes seen as a continuation of the usual conflict between the demand and supply side by other means. However, the actual purpose of an orderly S&OP process is to find an acceptable compromise between the demand situation and the supply situation in the common interest and for the company as a whole if the market requirements cannot be met in full and in a timely manner.

In order to successfully climb the ridges of S&OP planning, the demand side and the supply side must see themselves as a rope team. Sometimes one secures the other, sometimes it’s the other way around. An S&OP team is truly professional when it succeeds in coordinating market requirements and the supply situation with each other, i.e. when customer requirements are directed towards existing products and surplus quantities and actions are coordinated with the supply side in good time before they are offered on the market.