Reducing stocks without the risk of out-of-stock – a contradiction?

Stefan Hahn, Götz-Andreas Kemmner

The German retail sector has considerable inventory reduction potential that needs to be identified and leveraged. High stock levels both in the central warehouses and in the outlets cover up weak points in the processes that cause bottlenecks, out-of-stocks and delivery delays.

On average, 13% of retail sales are tied up in inventories. This results in an inventory range of well over one month. However, the resulting considerable cost reduction potential is often not recognized and lies dormant in retailers’ warehouses. This is astonishing when you consider the weak margins in this sector.

A decisive argument against reducing stock levels in the retail sector is certainly the fact that, despite modern logistics and ERC (Efficient Consumer Response) systems, stock-outs (gaps between shelves) still frequently occur in retail outlets. However, studies show that the main causes of stock-outs are usually found in the last 10 meters to the shelf. Consequently, they cannot be improved by optimizing the supply chain or by increasing stocks upstream in the supply chain.

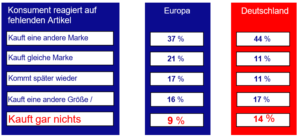

Missing items on the shelf lead to lower sales for retailers and manufacturers. According to studies, consumers very often switch brands rather than shopping locations if the desired product is not available on the shelf. However, if you look at the nine percent non-purchase rate, the European food retail trade, and therefore also manufacturers, lose over EUR 4 billion in sales every year due to items not being available on the shelves. In Germany, the non-purchase rate of 14% is even well above the European average.

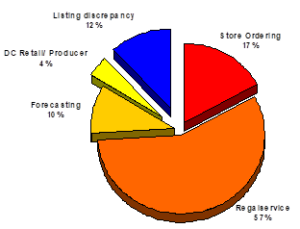

But why are many retail outlets unable to make sufficient deliveries? Studies show (e.g. OSA study Roland Berger 2003) that the area of “in-store logistics” (store ordering, shelf service) is a disproportionately high cause of errors. The most important causes here:

- Lack of staff for shelf stocking

- Poor warehouse organization

- Rare out-of-stock checks on the shelf (exception processing)

- Lack of shelf labels – Insufficient assortment implementation

- Incorrect book inventories

- Order triggered too late or not at all

This means that almost three-quarters of the identified shelf gaps occur within the store’s sphere of influence. 10% are due to the connected ERP system (scheduling and forecasting system) with incorrect forecasts, excessive minimum order quantities or incorrect parameterization at article and supplier level. Only 4% of the shelf gaps investigated were due to delivery errors by the manufacturer and 12% were caused by listing discrepancies! These figures show that incorrect disposition mechanisms at manufacturers and retailers are responsible for only 14% of out-of-stocks. However, they are responsible for a good 80% of the existing surplus stocks.

A look at purchasing behavior makes it clear how important product availability at the point of sale is for customers. As many as 14% of customers in German retail stores do not buy anything if the desired item cannot be found on the shelf. (Source: ECR Europe)

Almost three quarters of all availability problems are caused in the stores, particularly in the last 10 meters to the shelf.

These figures already show that a high level of delivery readiness and low inventories are not contradictory, but rather are components of efficient inventory management that need to be adjusted individually. Increasing stocks in order to achieve delivery readiness is therefore rarely the necessary answer. In most cases it is even wrong. Further studies show that manufacturers and retailers who manage their supply chain efficiently tend to achieve better out-of-stock rates with significantly lower inventories.

According to analysts at Lehman Brothers, inventory management is a central key to the success of the world’s largest retailer, Wal-Mart. At the beginning of 2006, WAL-MART launched an inventory reduction initiative, which should reduce inventories by 19% within the next 1-2 years, corresponding to a sales value of $6 billion. With an out-of-stock rate of 1.5%, WAL-MART intends to achieve an average annual inventory turnover of 10 across all product categories (source: SCD’s editorial staff 2006).

Improving delivery readiness and significantly reducing stock levels are not a contradiction in terms in the retail sector, but two necessary approaches to securing and improving competitiveness.

How can such ambitious goals be achieved?

In order to approach such goals, the entire supply chain from the manufacturers to the shelves must be carefully balanced. These include, among others:

- Assortment optimization through reduction of variants and SKUs (Stock Keeping Units)

- Efficient forecasting and scheduling

- Improving the accuracy of forecasts

- Optimization of the parameterization of the relevant control variables of the scheduling and forecasting system of the connected warehouse locations

- Synchronized data provision by suppliers via their own PoS and warehouse data

- Improving information sharing in the supply chain (Collaborative Planning, Forecasting and Replenishment (CPFR) – Retail Link)

- Tight organizational mechanisms from logistics to the stores

- Steadying the flow of goods by increasing order and delivery frequencies and shortening replenishment times

- Optimization of the ratio of goods flows that run via inventory-managed distribution (warehousing) and those goods flows that are processed via inventory-free distribution (cross-docking)

- an efficient key performance indicator system with KPIs (key performance indicators) to monitor the supply chain situation

Conclusion

It is not too little stock in the supply chain from the manufacturer to the retailer’s store, as is often assumed, but incorrect organizational processes in the stores that cause 70% of all availability problems on the shelves. On the contrary, inventories in the supply chain represent untapped potential for reducing working capital and lowering trading costs.

In numerous projects for the analysis of excess stock, Abels & Kemmner has been able to prove time and again that up to 25% reduction in stock could be achieved with the same degree of delivery readiness simply by correctly parameterizing the control variables of the existing scheduling system. In the tough competition between retailers, the ability of companies to manage and monitor their inventories in the future will therefore become increasingly important. Wal-Mart Inc. In the 2004 annual report, “Inventory growth at a rate less than half of sales growth is a key measure of our efficiency”. There is nothing more to add.