Inflation could continue – with consequences for supply chain management

Inflation could continue – with consequences for supply chain management

Inflation could persist in the coming years, as Raphaël Gallardo, chief economist at Carmignac, a French investment company, suspects [Quelle]. This would have consequences for supply chain management.

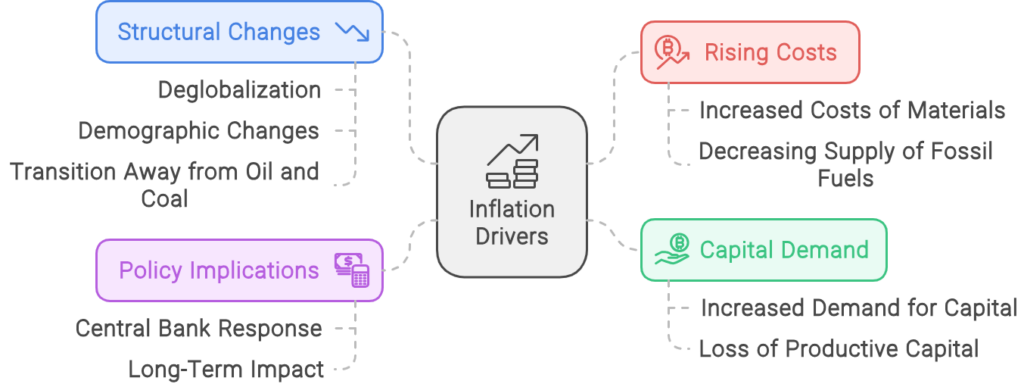

These are Gallardo’s arguments:

Structural changes in the global economy

1. deglobalization

– The end of world trade has a strong inflationary effect and increases inflation rates by around three percent annually

2. demographic changes

– The ageing population is expected to contribute to additional inflation of 0.3 to 0.4 percent annually

3. moving away from oil and coal

– The transition to clean energy will lead to a significant increase in inflation rates, with efforts to limit temperature rise increasing inflation by about 1.6 percent annually

Rising material and energy costs

1. increased material costs for the energy transition

– The cost of materials required for the energy transition, such as wind turbines, is expected to rise and contribute to higher inflation rates

2. declining supply of fossil fuels

– The declining supply of fossil fuels, coupled with reduced exploration of new reserves, is expected to lead to a faster decline in supply than demand, causing an annual increase in inflation of around 0.8 percent

Capital demand and loss of productive capital

1. increased demand for capital

– the need for capital to build new energy infrastructure will drive up demand, leading to higher interest rates and inflation

2. loss of productive capital

– The decommissioning and depreciation of old power plants and industrial facilities will lead to a loss of productive capital and contribute to an annual increase in inflation of around 0.7 percent

Policy implications

1.Central bank response

– Central banks may need to intervene more frequently and earlier to contain inflation, potentially leading to economic downturns

2.Long-term impact

– Inflationary pressures from the move away from oil and coal are expected to last for around a decade, affecting the economy and citizens over a longer period of time

Additional factors contributing to inflation

1.End of globalization

– The standstill in global trade since the 2008/09 financial crisis is expected to have an inflationary effect and increase inflation rates by around three percent annually

2. technological progress

– Technological advances such as digitalization and artificial intelligence may have deflationary effects, but it is unlikely that they will be able to fully offset the additional inflationary pressure.

3. climate change

– The continuation of man-made climate change is likely to contribute to a permanent increase in inflation rates, which will have a particular impact on food prices

Sustained inflation will have several consequences for supply chain management.

We expect the following effects:

1. higher costs:

Inflation can lead to higher costs for raw materials, components and services within the supply chain.

This situation can reduce profit margins and force companies to either bear the increased costs themselves or pass them on to consumers.

2. inventory management:

Companies could reduce their inventory levels to reduce tied-up capital and avoid the costs associated with inventory such as storage, depreciation and insurance.

However, this can lead to challenges in meeting customer demand and maintaining supply chain stability.

3. supplier relationships:

Inflation can put a strain on relationships with suppliers, especially if contracts are not adjusted for inflation or if suppliers exhibit opportunistic behavior in times of shortage.

This could lead to renegotiations or even the termination of contracts.

4. transportation costs:

The cost of international transportation, whether by sea, land or air, may increase, affecting the overall cost of goods and the reliability of delivery schedules.

5. fluctuations in demand:

Inflation can make demand more volatile, which makes forecasting and planning more difficult.

This can lead to overstocking or stock-outs, putting additional strain on the supply chain.

6. supply chain optimization:

Companies may need to rethink their supply chain strategies and the tools they use for planning and forecasting.

Over-reliance on tools such as Excel, which are not suited to complex supply chain management, can lead to errors and inefficiencies.

It could be time to rethink strategies and prepare accordingly.

The current equipment of many companies may not be sufficient to meet the challenges of the future.

– With increasing market chaos, the importance of probabilistic forecasts and appropriate safety stocks will increase.

– The interplay of demand uncertainty, product diversity, replenishment strategies, unreliable delivery times, capacity and financial constraints and other factors makes planning decisions extremely complex.

– Resilient materials management requires the simulation and continuous adaptation of replenishment strategies based on empirical data, which and reflect the realities of the market and the supply chain.

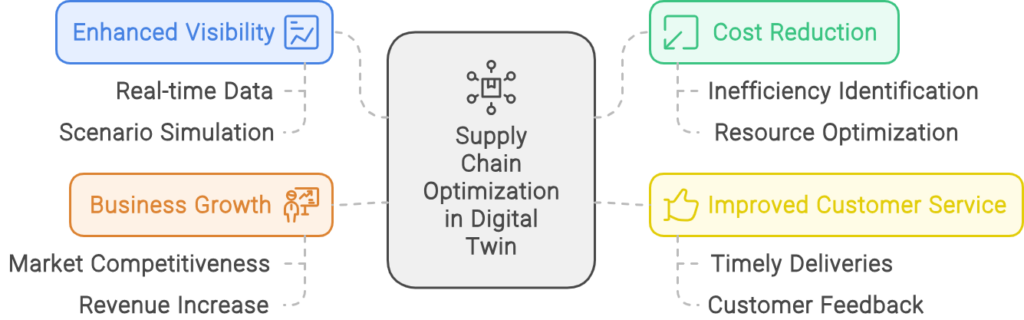

We use “Supply Chain Optimization in the Digital Twin” to support our customers in overcoming their supply chain challenges. What methods do you use?