Liquidity from holdings instead of self-imposed usurious interest rates

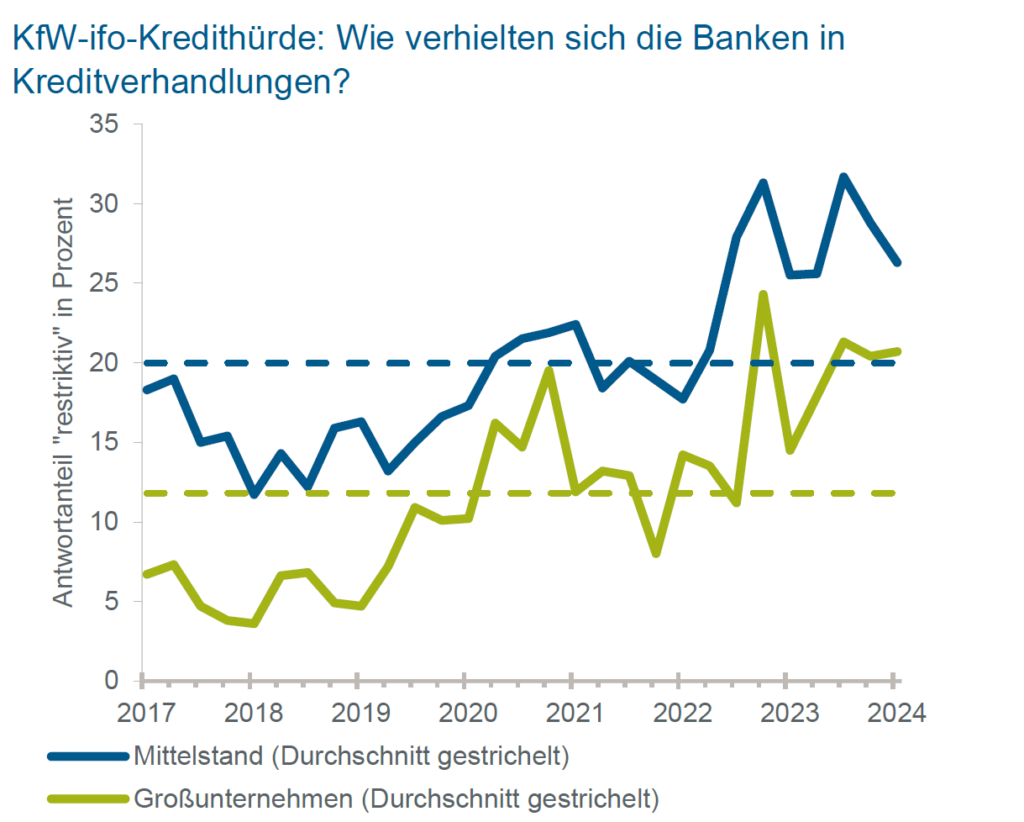

There is never enough money in a company and, as the “KfW-ifo credit hurdle” indicator shows, it is becoming increasingly difficult for companies to obtain bank loans.

In many companies, liquidity is hidden in the inventories, but this is not always easy to raise.

However, reducing inventories without jeopardizing delivery readiness is feasible with the right tools, such as an empirical simulation of value streams and supply chains.

The KfW-ifo credit hurdle* is a key figure that indicates the percentage of companies that classify bank behavior in credit negotiations as “restrictive”.

The proportion of companies struggling with restrictive lending by their banks has risen continuously in recent years.

Source: KfW Research Kfw-ifo credit hurdle Q1 2024

By reducing inventories while ensuring delivery readiness, companies not only gain liquidity, but also save significant costs.

Depending on the company and the analysis, the annual costs of warehousing amount to 19% to 30% of the inventory value: self-imposed usurious interest …

*For more information and the current report, please visit https://www.kfw.de/C39Cber-die-KfW/Newsroom/Aktuelles/News-Details_806656.html)