The economic parameters indicate that the economy will struggle more in the coming months. It may be time to take another look at the stocks. These not only tie up a lot of capital that might be urgently needed elsewhere in the company in bad times, but also cause high running costs.

Whether manufacturing or trading companies, we are all faced with the dilemma of having to keep at least some of our goods, production items or raw materials in stock in order to be able to supply customers or our own production or assembly departments with materials at short notice. On the one hand, you have to be able to deliver and, on the other, you have to keep your stocks under control.

The solution to this dilemma of delivery capability and inventory is often left to materials planning, logistics or supply chain management. However, it is a big mistake for entrepreneurs and managing directors not to take an interest in the mechanisms of inventory management and therefore not to understand the interrelationships. This is because the right positioning between delivery capability and inventory is an entrepreneurial task whose execution can be delegated, but not the responsibility for it.

If you understand the basic mechanisms and pay attention to a few key points, you can achieve the required delivery readiness with lower costs and inventories and, on the other hand, know what you need to invest in order to be able to deliver.

Delivery capability and inventory: not always a dilemma…

Experience and common sense tell us that a higher delivery capacity also requires a higher inventory. However, this is only partly true. Let us therefore first take a look at the cybernetics of stocks.

An article stock is basically made up of the stock required to satisfy the so-called basic requirements and the so-called safety stock. The basic requirement corresponds to the average material consumption during the replacement period. The safety stock is intended to cushion fluctuations in demand, because in practice daily consumption is not constant.

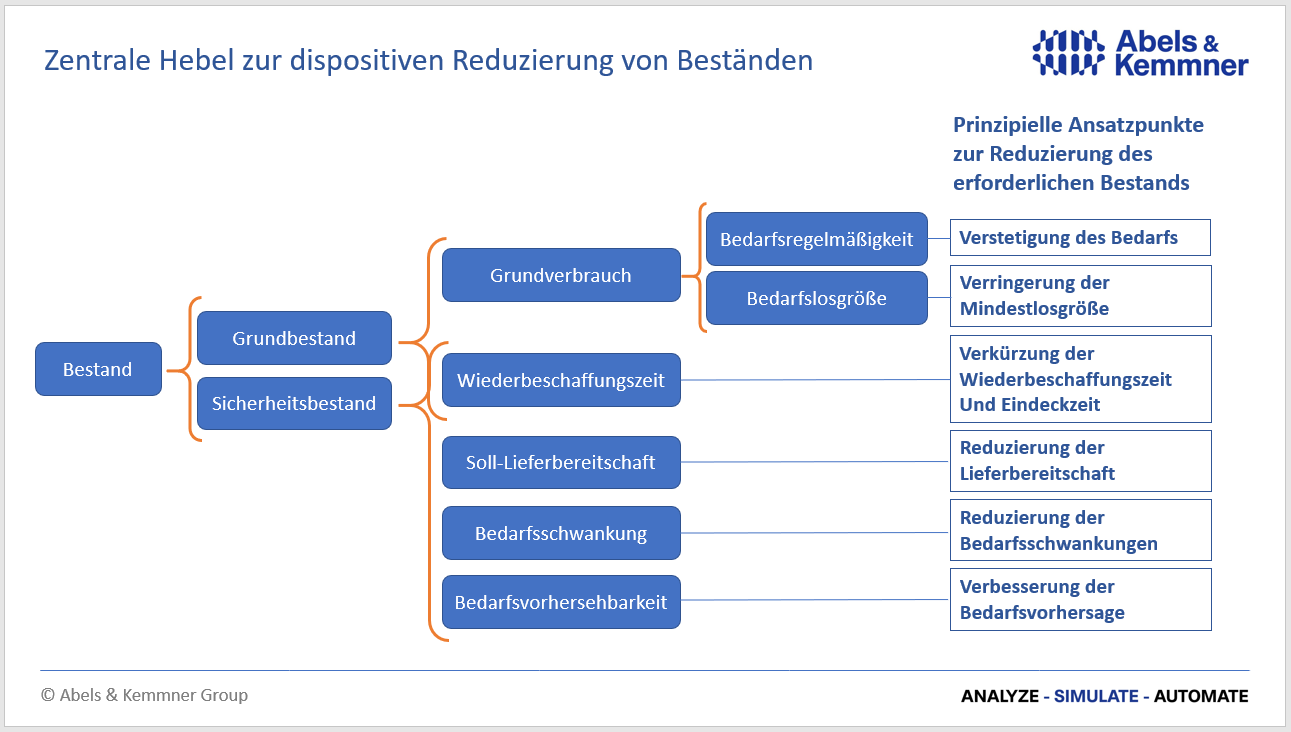

There are four main parameters that determine how extreme the trade-off between delivery readiness and inventory is (Fig. 1):

- The fluctuation strength of requirements on the stock issue side,

- the predictability of these requirements,

- the required readiness to deliver,

- the replenishment time to restock the item.

These parameters primarily affect the safety stock. Only the replacement time also has an influence on the basic requirement. This is proportional to the replenishment time: double the replenishment time results in double the basic requirement, halving the replenishment time results in half the basic requirement.

Under otherwise constant boundary conditions, the required stock level also increases as delivery readiness increases. Unfortunately, it does not do this in proportion to the readiness to deliver, but increasingly progressively. Particularly in delivery readiness areas above 93%, a small increase in the required delivery readiness can trigger a flood of additional stock required. Beyond 98%, an explosion in stocks must be expected.

If you want to understand it in more mathematical terms: the higher the required delivery readiness level, the more “standard deviations” of safety stock are required. The standard deviation is a measure of the fluctuation in demand; the greater the fluctuation, the higher the standard deviation. The standard deviation is simply stated in the form of a quantity or tonnage of the item.

That sounds bad, but it doesn’t necessarily have to be. The extent to which stocks actually explode depends on the other influencing parameters listed above: the predictability of requirements, the fluctuation in requirements and the replenishment time.

Strong fluctuations in demand that you cannot foresee act as a propellant for your stock explosion. Strong fluctuations in demand that you anticipate are much less critical. This is actually logical, because if you know what requirements you will face, you can prepare for them well and do not need to keep high safety stocks. Certain types of fluctuations in demand can be easily predicted; seasonality, for example. Unfortunately, a large part of the fluctuations in demand are purely chaotic. They can only be countered with correspondingly high safety stocks. At this point, experts have high hopes for developments in artificial intelligence. However, the results to date are still very modest.

In addition to fluctuations in demand and the predictability of demand, the replenishment time also plays a role in the required level of safety stocks. Common sense already tells you that the longer the replacement time, the greater the safety stock must be. Finally, the longer it takes to respond to growing demand, the greater the uncertainty as to how demand will develop. However, the correlation between the required safety stock and the replacement time is disproportionately low. Doubling the replacement time does not require twice as much safety stock. On closer inspection, this is also logical. Over a longer period of time, higher requirements in one period and lower requirements in another can partially balance each other out.

It’s nice that an extension of the replacement time doesn’t have such a drastic effect on safety stocks. But beware, if the replacement time is shortened, the game is reversed. If you manage to halve the replenishment time, this does not mean that the safety stocks are also halved. In this case, these are only reduced disproportionately. The shorter the replacement period, the less chance there is that higher requirements in one period will be offset by lower requirements in another period.

If you want to know the mathematics more precisely: Specifically, the safety stock changes according to the square root of the quotient of the two replacement times under consideration. If the replacement time is doubled, the required safety stock only increases by approx. 140% (root of 2). If the replacement time can be halved, the safety stock falls to approx. 71% (square root of 0.5).

The risks of good delivery capability for profitability

Once you have understood the cybernetics of stock, it is clear where the risks of high delivery readiness (93% or higher) lie with regard to efficient stocking and management. In the case of articles with strong fluctuations in demand, the high supply readiness leads to high safety stocks. These not only tie up a lot of capital, but also entail a high risk that some of the holdings will lose their value:

- Articles may exceed their best-before date,

- Articles may become technically obsolete,

- Items must be written off for accounting reasons.

A special situation can arise if you are required to keep items with a short shelf life and a high fluctuation in demand highly available for delivery. You then need high safety stocks that drive up the stock ranges, if necessary. even beyond the permitted storage period of the item. This can mean that stocks that are past their sell-by date have to be continuously destroyed. Beyond ecological criteria, the following applies in such cases: If you cannot pass on these costs to the sales price, you should reduce your readiness to deliver!

If you look at your stocked product portfolio, you will probably notice that you are confronted with a strongly fluctuating demand for some of your items, while another, usually smaller part, has a more even demand. With a so-called XYZ analysis, you can divide your articles transparently into three classes according to the size of the fluctuations in demand. X articles have low and Z articles have high fluctuations in demand. Y articles are in between.

For those who want to know the mathematical details: All articles with a coefficient of variation of less than 0.5 are classically regarded as X articles, all with a value up to 1 as Y articles and all above as Z articles.

You have probably already categorized your items into A, B and C classes. Normally, A articles are classified in such a way that they generate the first 80% of sales, B articles generate a further 15% and the last 5% is generated by C articles. You can now assign each of your stock items to an ABC and an XYZ class. This ABC/XYZ portfolio is a great help in the economic design of your stocks. You can use it to balance inventory levels (and costs) against the importance of sales.

On the one hand, you should try to reduce the delivery readiness level for items with strongly fluctuating demand (Z-items) in order to keep stock levels at an economical level. On the other hand, articles with high sales significance (A articles) should be kept more deliverable than C articles. In the ABC/XYZ portfolio, an attempt is made to “distribute” the readiness to deliver across the nine portfolio fields in such a way that the aim is to achieve a very high readiness to deliver for AX articles, which decreases towards the AY field and AZ field. As the contribution of articles to the company’s total sales decreases, the readiness to deliver is also generally reduced. A BX article therefore already has less availability than an AX article, but more than a CX article.

For those who want to sail higher on the technological wind: With appropriate optimization algorithms, this distribution of delivery readiness can be determined automatically depending on the total stock permitted. The optimization also works the other way round: depending on a required overall readiness to deliver, the stocks in the portfolio fields are balanced in such a way that the overall readiness to deliver is achieved with the lowest possible total stock.

As you can see, there is a lot you can do. However, the statistical mechanisms behind the cybernetics of stocks cannot be tricked. Unfortunately, it is not possible to achieve maximum availability with minimum stock. High delivery readiness does not hurt for every item. For a whole range of items, however, you have to choose between a low level of stock and a high level of availability.

High delivery capacity is not always necessary

Sales usually require a high level of readiness to deliver finished goods. This reflects the fear of missing out on sales if you are unable to deliver: If your sales department cannot deliver, customers will go to the competition. The correlation between delivery readiness and loss of sales is only really that consistent for commodities that are available on every street corner. Put it to the test and ask your sales department (or yourself) what happens if an item is not available. In the B-to-B sector, nothing happens in extreme cases because they can simply send the missing quantity with the subsequent delivery. In the B-to-C sector, a delivery may take a little longer if a component is missing. In the long term, unreliable delivery capability drives customers away, but if it remains a rare experience for the customer, it won’t break the world. Some initial values can even be used to estimate the extent to which an item is economically viable for delivery.

The market is what it is. What can still be done to reduce stocks?

Another look at the cybernetics of inventories shows us some further possibilities beyond the differentiation of the degree of readiness to deliver in order to reduce inventories through planning measures.

Reduction in replenishment time: We have already mentioned that reducing replenishment time has a positive effect on stocks. The stock required to cover the basic requirement is reduced in proportion to the replenishment time. The safety stock is falling disproportionately, but it is also falling.

In our consulting projects, we regularly find that replacement times are by no means as unchangeable as is often expected. It therefore makes sense to check whether something can be done about the replenishment times for items that are regularly procured or produced.

Sometimes it helps to ask once whether a shorter delivery time would be feasible, because the maintenance of replenishment times is often not as accurate as it should be. Suppliers, but also the company’s own production, rarely complain if the customer accepts a longer replenishment time as a given.

The time required for the subsequent delivery of an item, whether from in-house production or from a supplier, is often less dependent on the actual production time than on the waiting and idle times until production or the next production step can be started. In such cases, it helps to consider what can be done to shorten waiting and lying times. You can discuss…

- Raw material releases so that the supplier does not have to procure the required raw material when an item is ordered,

- Pre-production up to an intermediate storage stage, from which many different product variants are manufactured,

- Customize technical specifications.

Amazing effects sometimes arise when you have the leeway to discuss the required product specification with suppliers. Small changes to the technical specifications sometimes make it possible to significantly shorten the production processes and therefore also the throughput times.

Reducing the m ating time: Reducing the so-called mating time is also an effective means of reducing the stock. It only affects the basic stock, i.e. the stock required to cover basic needs. However, even in cases where the replacement time cannot be shortened, it is still possible to adjust the time it takes to cover the vehicle. The “lead time” is the period of time for which you would like to be supplied with material for an order or production order. An example makes this clear:

With a replenishment time of 10 working days and an average consumption of 50 pieces per day, the basic requirement and thus the basic stock is 500 pieces. If you procure material every 10 days, then order a batch size of 500 pieces. In this case, the covering time is 10 days, as is the replacement time. You could also decide to stock up for only 5 days at a time, i.e. stock up every 5 days. In this case, you would order 250 pieces every 5 days, which would be delivered after 10 days. Before the first order is delivered, the second order has already been placed; in both cases, the average stock level corresponds to half the order lot size + the safety stock. In the first case this would be 250 units, in the second only 125 units, in each case plus safety stock. The total portfolio was not halved as a result, as the base of the safety stock remains the same in both cases. If this base is very high, the effect can be minimal. However, this leverage has a drastic effect on items with a low safety stock.

Reducing the minimum batch size: Sometimes you don’t get as far as you would like with the reduction of the covering time because the supplier or your own production insists on a minimum batch size. In this case, it is of no use if you only want to stock up on materials for a short period of time, but the minimum lot size forces you to purchase quantities that cover your requirements for a much longer period.

A stock reduction initiative should also shake things up here and check whether the minimum lot sizes can be adjusted. The reasons for minimum batch sizes in production are usually set-up times. If the set-up of a system is complex and takes a long time, then production would also like to be allowed to manufacture for longer for reasons of efficiency and thus deliver larger production batches. In such cases, projects to reduce set-up times can help to reduce inventories in the value chain.

Stabilization of demand: More consistent demand leads to fewer fluctuations in demand and this automatically leads to lower safety stocks with the same readiness to deliver. For this reason, it is also worth thinking about this lever. In the B-to-C area, the possibilities are rather limited, unless you find starting points to motivate the customer to wait for their order if necessary. Sometimes it can be sensible and economical to give the customer a discount for being patient. In the B-to-B segment, it is easier to find starting points, as fluctuations in demand for articles do not always result from corresponding fluctuations in demand on the customer side. In some cases, evenly distributed requirements are combined into large order lots. The overlapping of large order batches from different customers ultimately leads to strong fluctuations in demand for an article.

If your customers order items from you that are in stock, it could make sense to reduce your own minimum order quantities in order to motivate customers to order smaller quantities more frequently. Added up across all customers, this can reduce the running costs for safety stocks more than it increases freight costs. This is especially true if the customer orders several other parts from you, so that the number of deliveries does not necessarily have to increase, but only the number of delivery items. To illustrate this with a simple example: instead of delivering product A in a large batch size one week and product B the following week, product A and product B could be delivered every week in halved batch sizes.

In addition to the planning measures mentioned above, there are also a number of organizational measures in cooperation with suppliers that can help you to reduce inventories. Two of these are mentioned here: Consignment stock and vendor managed inventory.

A consignment warehouse is a warehouse that is typically located near a customer or on the customer’s premises. The decisive factor here is that the goods remain the property of the supplier until they are removed. For you as a customer, the consignment warehouse has the advantage that the stocks it contains are not tied up in your capital. On the other hand, all other storage costs are generally incurred on your side. You are responsible for insuring your stocks and for the risk of obsolescence, and it is also your warehouse capacity, your warehouse technology and your warehouse staff that are used.

From a cost perspective, a consignment warehouse solution is therefore not always advantageous for you as a customer. What happens if you as a supplier are forced by your customers to maintain consignment warehouses? From a cost point of view, this can certainly be an advantage if you manage to dispense with further stocks of these items for this customer on your side of the business.

That leaves the capital commitment, but you may be able to make some adjustments to this in negotiations with your customers. Strictly speaking, it is not decisive whether capital is tied up in the form of inventories or in the form of receivables from customers. A consignment warehouse with a stock range and thus a capital commitment of three months and immediate payment of the quantities withdrawn by the customer is no worse than material deliveries that are invoiced directly but only paid for by the customer after a period of 90 days. Therefore, when setting up a consignment warehouse, try to negotiate short payment terms with your customer.

A Vendor Managed Inventory (VMI) concept is often seen as a further development of the consignment warehouse concept. Strictly speaking, this is a mechanism that can be operated in combination with a consignment warehouse, but also without a consignment warehouse. The basic idea behind VMI is that the supplier replenishes the stocks of its items in the customer’s warehouse itself. For this purpose, a minimum stock level and a maximum stock level are usually defined for each item, between which the stock of the item must lie. It is up to the supplier to decide exactly when to make additional deliveries; the only decisive factor is to keep the stock between the two limits.

Although a VMI mechanism means additional work for the supplier for item planning, it can have a positive effect on stocks. VMI allows you to decouple yourself from the often stochastic ordering mechanisms of your customers. We often find that suppliers do not (or cannot) manufacture items that they regularly supply to customers in line with customer orders and therefore place them in stock in order to be able to react quickly enough to customer orders. In such cases, you can benefit from a VMI concept because the decoupling from the customer’s order initiation makes it possible to stabilize rework. This not only allows you to reduce your delivery stocks to suppliers, but may even reduce fluctuations in demand throughout the entire supply and production chain, which can lead to lower safety stocks throughout the chain.

Finally rely on technology!

How can effective inventory management be implemented in practice? Not the way it is still done in many companies today: by hand!

We discuss Industry 4.0 and talk about how we need to increase labor productivity and that we are short of staff everywhere. Nevertheless, many companies assemble their inventories by hand. Although most companies use an ERP system or a merchandise management system, these systems are often only used as expensive typewriters in material planning. In order to achieve effective inventory management, it is important to understand that people are one of the biggest inventory drivers in the company.

On the one hand, there’s the planner, who is required to keep her stocks low, but who also experiences immediate pressure if some of the items she has planned “run dry”. A lack of material stocks usually leads to hectic efforts to obtain the required material as quickly as possible. Excessive stocks, on the other hand, relax the day’s work and are far less likely to lead to unpleasant conversations. You can’t blame the dispatchers for playing it safe. The effect is amplified if the management does not clearly support the intended reduction in inventory and does not back the scheduling department. In a project, a managing director once said: “As experts, please tell us what delivery readiness levels we should set for our articles, the only important thing for me is that we are always able to deliver!” Such thinking reliably leads to an increase in stocks. As a managing director, you must be aware that you have to be able to cope with non-delivery. 98% delivery readiness, for example, explicitly means that 2% of the required quantity should not be delivered on time; simply because this would be too expensive! I therefore like to make it clear to dispatchers that I don’t see it as their job to achieve 98% delivery readiness, but to ensure that 2% of requirements are not immediately available.

Ultimately, a person cannot completely detach themselves from their emotions when making dispositional decisions. You can only achieve strategic calm instead of operational hecticness in material planning if you rely more heavily on the planning algorithms of your IT systems. Humans should only intervene in the planning system’s scheduling proposals if they have additional information that has not been included in the planning system’s scheduling proposal. However, the prerequisite for this principle of action is that the article master data and the parameters of the algorithms are set correctly and that your planning system has the correct algorithms. Today, there are proven mechanisms for updating article master data continuously, mostly automatically and with little effort. The keyword here is “disposition rules”.

I would like to go into a little more detail about the challenges of the algorithms for forecasting and safety stock determination, as these are not taken into account in most ERP or merchandise management systems, which can have serious negative effects on stock levels and delivery readiness. To understand these challenges, we need to take another brief excursion into statistics.

Why your ERP system leads to incorrect forecasts and safety stocks

You have probably heard of the Gaussian normal distribution. In very simplified terms, this describes the way in which measured values of recurring events are distributed symmetrically around their mean value. In nature, practically all measured values are normally distributed. If you measure the height of the adult population, you can determine an average height. The size of individuals fluctuates around this mean value, so that the majority of people are close to the mean value, while there are only a small number of extremely large and extremely small people. This normal distribution principle applies to many values in nature.

Unfortunately, this law of normal distribution only applies to a limited extent to the market demand for an item. Unfortunately, most items do not have a normally distributed demand. However, all classic forecasting methods and methods for determining safety stocks assume that demand is “normally distributed”. If the corresponding formulas are used to deduce future expected market requirements from past sales or stock-outs, calculation errors occur. Forecast values and safety stocks are either too high or too low. As a result, you either hold more stock than required and therefore achieve a readiness to deliver that is higher than desired, or you have too little stock and therefore do not achieve the required readiness to deliver. As a result, you are struggling with overstocks of some items and are unable to deliver sufficient quantities of others. Does this sound familiar to you?

You can easily check for yourself whether the demand for your items is normally distributed or not: Determine the mean value and the median for the items from the monthly consumption quantities of the last 12 or 24 months and compare the two characteristic values for each item. If the mean and median are different, demand is not normally distributed. If the median and mean coincide, demand may or may not be normally distributed.

How can we deal with the problem of the lack of normal distribution in forecasting and safety stock determination? For certain articles, the errors are small and the classic methods are sufficient. During the suggested recalculation, you may have noticed that there are no major deviations between the median and mean value for the regular articles (X articles), but there are for the Y and Z articles. For X articles, the classic methods are therefore more likely to be sufficient.

However, so-called “distribution-free methods” should be used for the more irregular items. These procedures are particularly important for the critical determination of safety stocks. Unfortunately, they are not offered in the ERP systems I am familiar with, but only in selected special systems for sales forecasting. They are too complicated for the forecasting world in Excel.

Sometimes a provisional solution can help you, which is not provided by most ERP systems, but can be managed using a spreadsheet, the “forecast bias”. The forecast bias describes whether a forecast regularly delivers forecast values that are too high or too low. If your forecast is always slightly too low, you must increase the forecast values by a correction value or vice versa. The forecast bias only helps you with the forecast values, not with the all-important safety stocks.

The mechanism of simulative forecasting goes one step further than distribution-free methods. This mechanism is also reserved for special systems. Let us therefore take a final look at such special systems.

Additional software for sales forecasting, safety stock determination and inventory management can quickly pay for itself

ERP systems are generalist systems. They must provide support for a wide range of tasks. It is therefore not surprising that only the larger providers have the resources to deal with special topics and provide special solutions for specific tasks. These solutions are often very expensive. There is a wide range of special additional programs for demand forecasting, material planning and inventory management.

In general, four groups of add-on systems can be distinguished: The first group consists of systems that are only designed for a specific ERP system. These systems usually run “in” the corresponding ERP system. They therefore offer close integration, but at the expense of flexibility and solution depth.

The second group comprises low-end systems. They are inexpensive, but only offer very limited functionality. The target group for these systems are small companies that are forced to compromise on functionality because they feel they cannot afford more expensive, more powerful systems. This group of add-on systems only makes sense for very simple ERP or merchandise management systems, as their performance hardly exceeds that of the more powerful ERP systems themselves. However, the user interface of these add-on systems is more user-friendly than that of many ERP systems.

A third group of additional systems for material planning includes high-end systems, which are often intended for large corporations in specific industries and are extremely expensive.

Finally, there is a group of systems that are geared towards medium-sized companies. Most companies find the best price/performance ratio for their problem in this group of systems. The scope and depth of services offered by the established systems in this market are high, but there are also significant differences in price and performance. The functional scope of these systems usually also meets the requirements of large-scale industry. However, the providers themselves are SMEs and do not have the kind of sales structures required for corporate customers. Medium-sized user companies can communicate with these system providers on an equal footing; an advantage that should not be underestimated when it comes to system implementation and ongoing support.

Another software program in addition to the ERP system? From my perspective, this is a clear recommendation based on economic considerations: High-performance additional systems that meet the requirements described above can pay for themselves from an average portfolio size of one million euros. From a portfolio of 5 million, it is not really excusable to forego the effect of these systems, because otherwise you are constantly losing money and tying up unnecessary capital. Because every million in unnecessary stock quickly costs you €190,000 to €300,000 in lost revenue per year!

Photo: Manu Dias/AGECOM